Sears 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

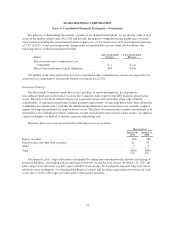

Domestic Credit Agreement

We have a $2.4 billion domestic credit agreement (the “Domestic Credit Agreement”) in place as a funding

source for general corporate purposes. The Domestic Credit Agreement includes a $1.5 billion letter of credit

sub-limit and an accordion feature that gives us the flexibility, subject to certain terms and conditions, to increase

the size of the credit facility, or add a term loan tranche to the Domestic Credit Agreement, in an aggregate

amount of up to $1.0 billion. The Domestic Credit Agreement, which has an expiration date of June 2012, is an

asset based revolving credit facility under which Sears Roebuck Acceptance Corp. (“SRAC”) and Kmart

Corporation are the borrowers. The Domestic Credit Agreement is secured by a first lien on most of our domestic

inventory and credit card and pharmacy receivables, and determines availability pursuant to a borrowing base

formula.

The Domestic Credit Agreement limits our ability to make restricted payments, including dividends and

share repurchases, if availability under the credit facility, as defined, is less than 25% (15% during the holiday

period, which is defined as October 15 to December 15). It also imposes various other requirements which take

effect if availability falls below designated thresholds, including a cash dominion requirement and a requirement

that the fixed charge ratio at the last day of any quarter be not less than 1.0 to 1.0. We have also agreed to limit

the amount of cash accumulated when borrowings are outstanding under the Domestic Credit Agreement.

At January 29, 2011, we had no borrowings outstanding under the Domestic Credit Agreement. We had

$235 million of letters of credit outstanding under the Domestic Credit Agreement. As a result, our availability

under the agreement was $2.2 billion at January 29, 2011. The majority of the letters of credit outstanding are

used to provide collateral for our insurance programs.

Senior Secured Notes

In October 2010, we sold $1 billion aggregate principal amount of senior secured notes (the “Notes”), which

bear interest at 6

5

⁄

8

% per annum and mature on October 15, 2018. Concurrent with the closing of the sale of the

Notes, the Company sold $250 million aggregate principal amount of Notes to the Company’s domestic pension

plan in a private placement. The Notes are guaranteed by certain subsidiaries of the Company and are secured by

a security interest in certain assets consisting primarily of domestic inventory and credit card receivables (the

“Collateral”). The lien that secures the Notes is junior in priority to the lien on such assets that secures

obligations under the Domestic Credit Agreement, as well as certain other first priority lien obligations. The

Company used the net proceeds of this offering to repay borrowings outstanding under the Domestic Credit

Agreement on the settlement date and to fund the working capital requirements of our retail businesses, capital

expenditures and for general corporate purposes. The indenture under which the Notes were issued contains

restrictive covenants that, among other things, (1) limit the ability of the Company and certain of its domestic

subsidiaries to create liens and enter into sale and leaseback transactions and (2) limit the ability of the Company

to consolidate with or merge into, or sell other than for cash or lease all or substantially all of its assets to,

another person. The indenture also provides for certain events of default, which, if any occur, would permit or

require the principal and accrued and unpaid interest on all the then outstanding notes to be due and payable

immediately. Generally, the Company is required to offer to repurchase all outstanding Notes at a purchase price

equal to 101% of the principal amount if the borrowing base (as calculated pursuant to the indenture) falls below

the principal value of the notes plus any other indebtedness for borrowed money that is secured by liens on the

Collateral for two consecutive quarters or upon the occurrence of certain change of control triggering events. The

Company may call the Notes at a premium based on the “Treasury Rate” as defined in the indenture, plus 50

basis points. We have agreed to offer to exchange the Notes held by nonaffiliates for a new issue of substantially

identical notes registered under the Securities Act of 1933, as amended.

64