Sears 2010 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

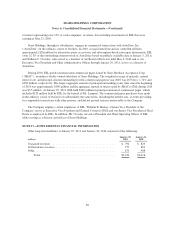

Notes to Consolidated Financial Statements—(Continued)

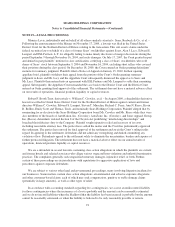

NOTE 19—LEGAL PROCEEDINGS

Maurice Levie, individually and on behalf of all others similarly situated v. Sears, Roebuck & Co., et al. –

Following the announcement of the Merger on November 17, 2004, a lawsuit was filed in the United States

District Court for the Northern District of Illinois relating to the transaction. This suit asserts claims under the

federal securities laws on behalf of a class of former Sears’ stockholders against Sears, Alan J. Lacy, Edward S.

Lampert and ESL Partners, L.P. for allegedly failing to make timely disclosure of merger discussions during the

period September 9 through November 16, 2004, and seeks damages. On July 17, 2007, the Court granted in part

and denied in part plaintiffs’ motion for class certification, certifying a class of Sears’ stockholders who sold

shares of Sears’ stock between September 9, 2004 and November 16, 2004, excluding short sellers who covered

their positions during the class period. On December 18, 2009, the Court entered an Order granting defendants’

motions for summary judgment. Plaintiffs filed a Notice of Appeal on January 15, 2010. In their opening

appellate brief, plaintiffs withdrew their appeal from the portion of the Court’s Order granting summary

judgment to Sears and Mr. Lacy and the Appellate Court subsequently dismissed the appeal as to Sears and

Mr. Lacy. Plaintiffs then entered into an agreement with ESL Partners and Mr. Lampert to settle their remaining

appeal. Subsequently, the Appellate Court remanded the case back to the District Court and the District Court

entered an Order granting final approval of the settlement. The settlement does not have a material adverse effect

on our results of operations, financial position, liquidity or capital resources.

Robert F. Booth Trust, derivatively v. William C. Crowley, et al. – In August 2009, a shareholder derivative

lawsuit was filed in United States District Court for the Northern District of Illinois against current and former

directors William C. Crowley, Edward S. Lampert, Steven T. Mnuchin, Richard C. Perry, Ann N. Reese, Kevin

B. Rollins, Emily Scott and Thomas Tisch, and nominally Sears Holdings Corporation. Plaintiff alleged that by

nominating for re-election to the Sears Holdings Corporation board Mr. Crowley and Ms. Reese while they were

also members of the boards of AutoNation, Inc. (Crowley), AutoZone, Inc. (Crowley), and Jones Apparel Group,

Inc. (Reese), defendants violated Section 8 of the Clayton Act prohibiting “interlocking directorships” and

breached their fiduciary duty to the Company. Plaintiff sought injunctive relief and recovery of its costs,

including reasonable attorney fees. The parties have settled the matter and the Court has preliminarily approved

the settlement. The parties have moved for final approval of the settlement and await the Court’s ruling in this

regard. In agreeing to the settlement, defendants did not admit any wrongdoing and denied committing any

violation of law. Defendants agreed to the settlement solely to eliminate the uncertainties, burden and expense of

further protracted litigation. The settlement does not have a material adverse effect on our annual results of

operations, financial position, liquidity or capital resources.

We are a defendant in several lawsuits containing class-action allegations in which the plaintiffs are current

and former hourly and salaried associates who allege various wage and hour violations and unlawful termination

practices. The complaints generally seek unspecified monetary damages, injunctive relief, or both. Further,

certain of these proceedings are in jurisdictions with reputations for aggressive application of laws and

procedures against corporate defendants.

We are subject to various other legal and governmental proceedings, many involving litigation incidental to

our businesses. Some matters contain class action allegations, environmental and asbestos exposure allegations

and other consumer-based claims, each of which may seek compensatory, punitive or treble damage claims

(potentially in large amounts), as well as other types of relief.

In accordance with accounting standards regarding loss contingencies, we accrue an undiscounted liability

for those contingencies where the incurrence of a loss is probable and the amount can be reasonably estimated

and we do not record liabilities when the likelihood that the liability has been incurred is probable but the amount

cannot be reasonably estimated, or when the liability is believed to be only reasonably possible or remote.

91