Sears 2010 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

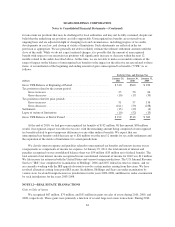

Because litigation outcomes are inherently unpredictable, these assessments often involve a series of complex

assessments by management about future events and can rely heavily on estimates and assumptions. While the

consequences of certain unresolved proceedings are not presently determinable, an adverse outcome from certain

matters could have a material adverse effect on our earnings in any given reporting period. However, in the

opinion of our management, after consulting with legal counsel, and taking into account insurance and reserves,

the ultimate liability is not expected to have a material adverse effect on our financial position, liquidity or

capital resources.

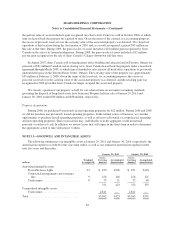

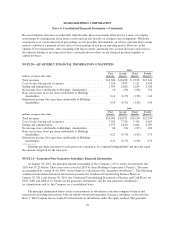

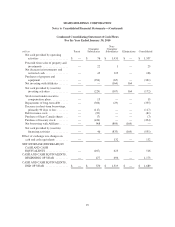

NOTE 20—QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

2010

millions, except per share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter(1)

Total revenues ............................................ $10,046 $10,458 $ 9,678 $13,144

Cost of sales, buying and occupancy ........................... 7,216 7,635 7,121 9,476

Selling and administrative ................................... 2,555 2,606 2,630 2,780

Net income (loss) attributable to Holdings’ shareholders ........... 16 (39) (218) 374

Basic net income (loss) per share attributable to Holdings’

shareholders ............................................ 0.14 (0.35) (1.98) 3.43

Diluted net income (loss) per share attributable to Holdings’

shareholders ............................................ 0.14 (0.35) (1.98) 3.43

2009

millions, except per share data

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter(2)

Total revenues ............................................ $10,055 $10,551 $10,190 $13,247

Cost of sales, buying and occupancy ........................... 7,182 7,756 7,419 9,467

Selling and administrative ................................... 2,573 2,630 2,664 2,787

Net income (loss) attributable to Holdings’ shareholders ........... 26 (94) (127) 430

Basic net income (loss) per share attributable to Holdings’

shareholders ............................................ 0.22 (0.79) (1.09) 3.75

Diluted net income (loss) per share attributable to Holdings’

shareholders ............................................ 0.21 (0.79) (1.09) 3.74

Earnings per share amounts for each quarter are required to be computed independently and may not equal

the amount computed for the total year.

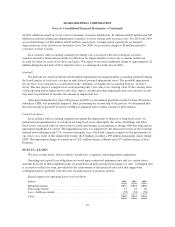

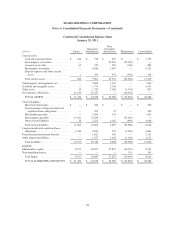

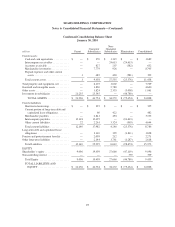

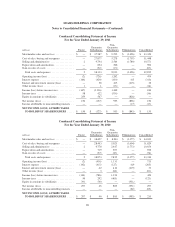

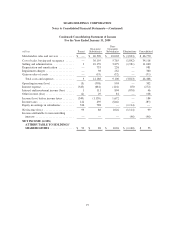

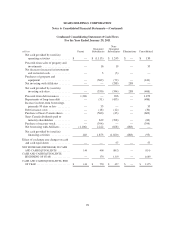

NOTE 21—Guarantor/Non-Guarantor Subsidiary Financial Information

At January 29, 2011, the principal amount outstanding of the Company’s 6

5

⁄

8

% senior secured notes due

2018 was $1.25 billion. These notes were issued in 2010 by Sears Holdings Corporation (“Parent”). The notes

are guaranteed by certain of our 100% owned domestic subsidiaries (the “guarantor subsidiaries”). The following

condensed consolidated financial information presents the Condensed Consolidating Balance Sheets at

January 29, 2011 and January 30, 2010, the Condensed Consolidating Statements of Income and Cash Flows for

2010, 2009 and 2008 of (i) Parent; (ii) the guarantor subsidiaries; (iii) the non-guarantor subsidiaries;

(iv) eliminations and (v) the Company on a consolidated basis.

The principal elimination entries relate to investments in subsidiaries and inter-company balances and

transactions including transactions with our wholly-owned non-guarantor insurance subsidiary as described in

Note 3. The Company has accounted for investments in subsidiaries under the equity method. The guarantor

92