Sears 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

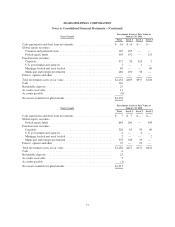

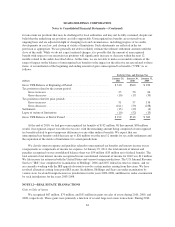

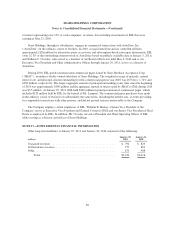

Aggregate Amortization Expense

2010 ............................................................ $ 69

2009 ............................................................ 74

2008 ............................................................ 84

Estimated Amortization

2011 ............................................................ $ 63

2012 ............................................................ 59

2013 ............................................................ 36

2014 ............................................................ 27

2015 ............................................................ 14

Thereafter ....................................................... 129

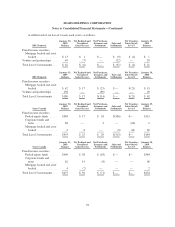

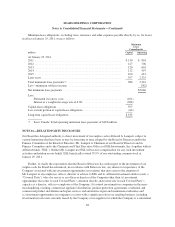

Goodwill is the excess of the purchase price over the fair value of the net assets acquired in business

combinations accounted for under the purchase method. We recorded $1.7 billion in goodwill in connection with

the Merger. We recorded $12 million in connection with our acquisition of an additional 3% interest in Sears

Canada during 2008.

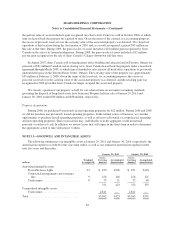

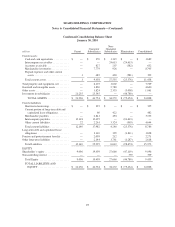

Changes in the carrying amount of goodwill by segment during years 2009 and 2010 are as follows:

millions

Sears

Domestic

Sears

Canada Total

Balance, January 30, 2010 and January 29, 2011:

Goodwill ....................................................... $1,359 $295 $1,654

Accumulated impairment charges .................................... (262) — (262)

$1,097 $295 $1,392

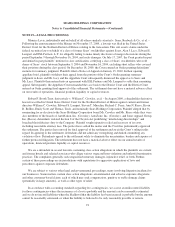

In accordance with accounting standards for goodwill and other intangible assets, goodwill is not amortized

but requires testing for potential impairment, at a minimum on an annual basis, or when indications of potential

impairment exist. The impairment test for goodwill utilizes a fair value approach. The impairment test for

identifiable intangible assets not subject to amortization is also performed annually or when impairment

indications exist, and consist of a comparison of the fair value of the intangible asset with its carrying amount.

Identifiable intangible assets that are subject to amortization are evaluated for impairment using a process similar

to that used to evaluate other long-lived assets. Our annual impairment analysis is performed at the last day of

our November accounting period each year. See Note 14 for further information regarding our impairment

charges recorded in 2008.

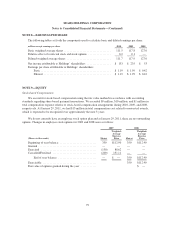

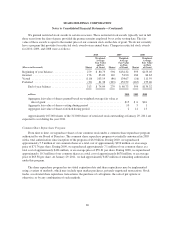

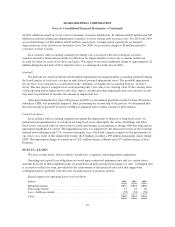

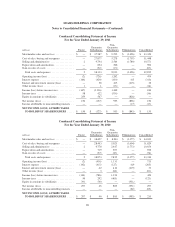

NOTE 14—STORE CLOSINGS AND IMPAIRMENTS

Store Closings and Severance

We closed 11, 43 and 24 stores in our Kmart segment and 15, 19 and 22 stores in our Sears Domestic

segment during 2010, 2009 and 2008, respectively. For 2010, 2009 and 2008, we recorded charges related to

these store closings of $13 million, $65 million and $27 million at Kmart, respectively, which included $6

million, $27 million and $15 million recorded in cost of sales for inventory clearance markdowns and $7 million,

$35 million and $12 million recorded in selling and administrative expenses for store closing and severance

costs. For 2009, we recorded charges of $3 million in depreciation expense for accelerated depreciation on assets

in stores we decided to close. For 2010, 2009 and 2008, we recorded charges related to these store closings of

$13 million, $49 million and $50 million at Sears Domestic, respectively, which included $6 million, $10 million

86