Sears 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

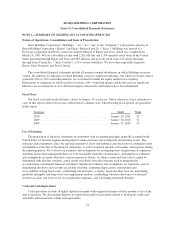

Notes to Consolidated Financial Statements—(Continued)

purchase contracts denominated in U.S. dollars. As a result, we primarily use derivatives as a risk management

tool to decrease our exposure to fluctuations in the foreign currency market. We primarily use foreign currency

forward contracts to hedge the foreign currency exposure of our net investment in Sears Canada against adverse

changes in exchange rates and foreign currency collar contracts to hedge against foreign currency exposure

arising from Sears Canada’s inventory purchase contracts denominated in U.S. dollars.

We use derivative financial instruments, including interest rate swaps and caps, to manage our exposure to

movements in interest rates.

Hedges of Net Investment in Sears Canada

When applying hedge accounting treatment to our derivative transactions, we formally document our hedge

relationships, including identification of the hedging instruments and the hedged items, as well as our risk

management objectives and strategies for undertaking the hedge transaction. We also formally assess, both at

inception and at least quarterly thereafter, whether the derivatives that are used in hedging transactions are highly

effective in offsetting changes in either the fair value or cash flows of the hedged item. If it is determined that a

derivative ceases to be a highly effective hedge, we discontinue hedge accounting.

For derivatives that are designated as hedges of our net investment in Sears Canada, we assess effectiveness

based on changes in spot currency exchange rates. Changes in spot rates on the derivatives are recorded in the

currency translation adjustments line in Accumulated Other Comprehensive Income and remain there until such

time that we substantially liquidate or sell our holdings in Sears Canada.

Sears Canada Hedges of Merchandise Purchases

Sears Canada mitigates the risk of currency fluctuations on offshore merchandise purchases denominated in

U.S. currency by purchasing U.S. dollar denominated collar contracts for a portion of its expected requirements.

Since Holdings’ functional currency is the U.S. dollar, we are not directly exposed to the risk of exchange rate

changes due to Sears Canada’s merchandise purchases, and therefore we do not account for these instruments as

a hedge of our foreign currency exposure risk. Changes in the fair value of these contracts are recorded in the

consolidated statement of income as a component of other income each period.

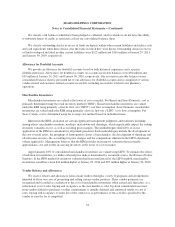

Hedges of Interest Rates and Other Foreign Currency

For interest rate swaps and caps that have been designated and qualify as hedges, both the effective and

ineffective portions of the changes in the fair value of the derivative, along with the offsetting gain or loss on the

designated hedged item that is attributable to the hedged risk, are recognized in the consolidated statements of

income in the same account as the hedged item, as a component of interest expense. Changes in the fair value of

interest rate swaps and caps that do not qualify as hedges are recognized currently as a component of interest

expense. The foreign currency forward contracts are recorded on the consolidated balance sheet at fair value and,

to the extent they have been designated and qualify for hedge accounting treatment, an offsetting amount is

recorded as a component of other comprehensive income, net of income tax effects. Changes in the fair value of

those forward contracts for which hedge accounting is not applied are recorded in the consolidated statement of

income as a component of other income. Certain of our currency forward contracts require collateral to be posted

in the event our liability under such contracts reaches a predetermined threshold. Cash collateral posted under

these contracts is recorded as part of our restricted cash balance.

57