Sears 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

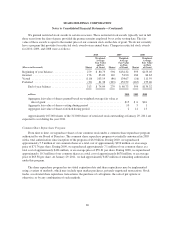

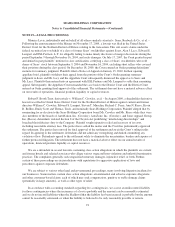

the gain on sales of assets included a gain recognized on a Sears Auto Center we sold in October 2006, at which

time we leased back the property for a period of time. Given the terms of the contract, for accounting purposes,

the excess of proceeds received over the carrying value of the associated property was deferred. We closed our

operations at this location during the first quarter of 2010 and, as a result, recognized a gain of $35 million on

this sale at that time. During 2009, the gain on sales of assets included a $44 million gain recognized by Sears

Canada on the sale of its former headquarters. During 2008, the gain on sale of assets included a $32 million

pre-tax gain recognized on the sale of Sears Canada’s Calgary downtown full-line store.

In August 2007, Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario for

proceeds of $81 million Canadian, net of closing costs. Sears Canada leased back the property under a leaseback

agreement through March 2009, at which time it finished its relocation of all head office operations to previously

underutilized space in the Toronto Eaton Centre, Ontario. The carrying value of the property was approximately

$35 million at February 2, 2008. Given the terms of the leaseback, for accounting purposes, the excess of

proceeds received over the carrying value of the associated property was deferred, and the resulting gain was

recognized in 2009 given that Sears Canada no longer occupied the associated property.

We classify a portion of our property as held for sale when criteria set out under accounting standards

governing the disposal of long-lived assets have been met. Property held for sale at January 29, 2011 and

January 30, 2010 totaled $36 million and $38 million, respectively.

Property Acquisitions

During 2008, we purchased 9 previously leased operating properties for $22 million. During 2010 and 2009,

we did not purchase any previously leased operating properties. In the normal course of business, we consider

opportunities to purchase leased operating properties, as well as offers to sell owned, or assign leased, operating

and non-operating properties. These transactions may, individually or in the aggregate, result in material

proceeds or outlays of cash. In addition, we review leases that will expire in the short-term in order to determine

the appropriate action to take with respect to them.

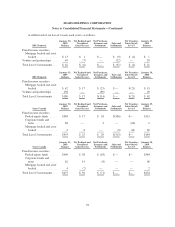

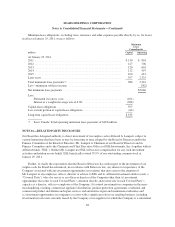

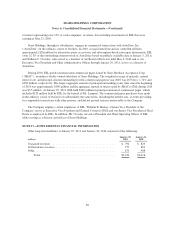

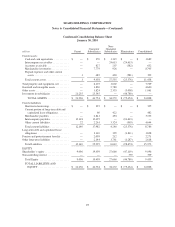

NOTE 13—GOODWILL AND INTANGIBLE ASSETS

The following summarizes our intangible assets at January 29, 2011 and January 30, 2010, respectively, the

amortization expenses recorded for the years then ended, as well as our estimated amortization expense for the

next five years and thereafter.

January 29, 2011 January 30, 2010

millions

Weighted

Average Life

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Amortized intangible assets

Favorable lease rights ................. 23 $ 450 $226 $ 451 $194

Contractual arrangements and customer

lists .............................. 9 226 146 226 121

Trade names ......................... 8 75 51 75 40

751 423 752 355

Unamortized intangible assets

Trade names ......................... 2,811 — 2,811 —

Total ................................... $3,562 $423 $3,563 $355

85