Sears 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

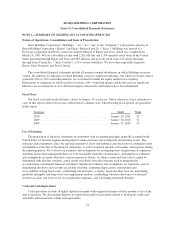

Notes to Consolidated Financial Statements—(Continued)

its carrying amount. A significant amount of judgment is involved in determining if an indicator of impairment

has occurred. Such indicators may include, among others: a significant decline in our expected future cash flows;

a sustained, significant decline in our stock price and market capitalization; a significant adverse change in legal

factors or in the business climate; unanticipated competition; and the testing for recoverability of a significant

asset group within a reporting unit. Any adverse change in these factors could have a significant impact on the

recoverability of these assets and could have a material impact on our consolidated financial statements.

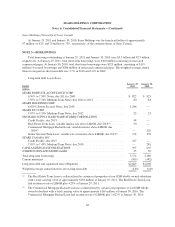

Goodwill Impairment Assessments

Our goodwill resides in multiple reporting units. The goodwill impairment test involves a two-step process.

The first step is a comparison of each reporting unit’s fair value to its carrying value. We estimate fair value

using the best information available, using both a market participant approach, as well as a discounted cash flow

model, commonly referred to as the income approach. The market participant approach determines the value of a

reporting unit by deriving market multiples for reporting units based on assumptions potential market participants

would use in establishing a bid price for the unit. This approach therefore assumes strategic initiatives will result

in improvements in operational performance in the event of purchase, and includes the application of a discount

rate based on market participant assumptions with respect to capital structure and access to capital markets. The

income approach uses a reporting unit’s projection of estimated operating results and cash flows that is

discounted using a weighted-average cost of capital that reflects current market conditions. The projection uses

management’s best estimates of economic and market conditions over the projected period, including growth

rates in sales, costs, estimates of future expected changes in operating margins and cash expenditures. Other

significant estimates and assumptions include terminal value growth rates, future estimates of capital

expenditures and changes in future working capital requirements. Our final estimate of fair value of reporting

units is developed by equally weighting the fair values determined through both the market participant and

income approaches.

If the carrying value of the reporting unit is higher than its fair value, there is an indication that impairment

may exist and the second step must be performed to measure the amount of impairment loss. The amount of

impairment is determined by comparing the implied fair value of reporting unit goodwill to the carrying value of

the goodwill in the same manner as if the reporting unit was being acquired in a business combination. See Notes

13 and 14 to the Consolidated Financial Statements for further information regarding goodwill and related

impairment charges recorded during 2008.

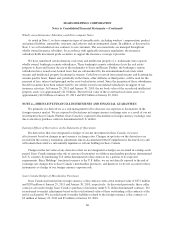

Intangible Asset Impairment Assessments

We consider the income approach when testing intangible assets with indefinite lives for impairment on an

annual basis. We determined that the income approach, specifically the relief from royalty method, was most

appropriate for analyzing our indefinite-lived assets. This method is based on the assumption that, in lieu of

ownership, a firm would be willing to pay a royalty in order to exploit the related benefits of this asset class. The

relief from royalty method involves two steps: (i) estimation of reasonable royalty rates for the assets and (ii) the

application of these royalty rates to a net sales stream and discounting the resulting cash flows to determine a

value. We multiplied the selected royalty rate by the forecasted net sales stream to calculate the cost savings

(relief from royalty payment) associated with the assets. The cash flows are then discounted to present value by

the selected discount rate and compared to the carrying value of the assets.

Financial Instruments and Hedging Activities

We are exposed to fluctuations in foreign currency exchange rates as a result of our net investment in Sears

Canada. Further, Sears Canada is exposed to fluctuations in foreign currency exchange rates due to inventory

56