Sears 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

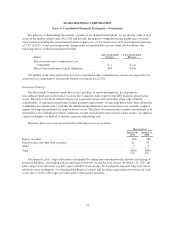

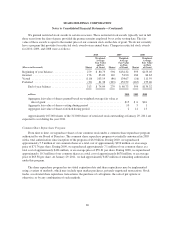

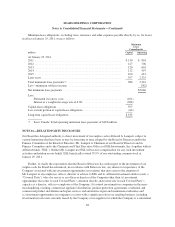

millions

January 29,

2011

January 30,

2010

Deferred tax assets and liabilities

Deferred tax assets:

Federal benefit for state and foreign taxes ................................. $ 167 $ 179

Accruals and other liabilities ........................................... 128 232

Capital leases ....................................................... 143 159

NOL carryforwards ................................................... 250 306

Postretirement benefit plans ............................................ 241 176

Pension ............................................................ 550 664

Deferred revenue ..................................................... 231 202

Credit carryforwards .................................................. 356 156

Other .............................................................. 111 113

Total deferred tax assets ................................................... 2,177 2,187

Valuation allowance ...................................................... (153) (131)

Net deferred tax assets ................................................ 2,024 2,056

Deferred tax liabilities:

Trade names/Intangibles ............................................... 1,161 1,186

Property and equipment ............................................... 292 304

Inventory ........................................................... 379 264

Other .............................................................. 71 203

Total deferred tax liabilities ................................................ 1,903 1,957

Net deferred tax asset ..................................................... $ 121 $ 99

We account for income taxes in accordance with accounting standards for such taxes, which requires that

deferred tax assets and liabilities be recognized using enacted tax rates for the effect of temporary differences

between the financial reporting and tax bases of recorded assets and liabilities. Accounting standards also require

that deferred tax assets be reduced by a valuation allowance if it is more likely than not that some portion of or

all of the deferred tax asset will not be realized.

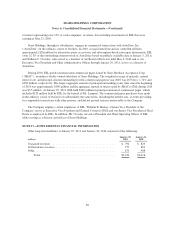

At January 29, 2011, we utilized the remaining $269 million Federal net operating loss (“NOL”)

carryforwards from the Predecessor Company. We have credit carryforwards of $356 million, which will expire

between 2015 and 2031.

At the end of 2009, we had a state NOL deferred tax asset of $212 million and a valuation allowance of

$131 million. In 2010, there was a net addition to the state NOL deferred tax asset of $38 million, bringing the

ending balance to $250 million. The additional NOLs were the result of additional state losses incurred in 2010,

netted against NOL expirations. The valuation allowance increased by $22 million, to $153 million. Additional

state valuation allowances were created against the state losses incurred in 2010 and were netted against state

valuation allowances reversals due to expiring state NOLs in 2010. The state NOLs will predominantly expire

between 2017 and 2030.

Accounting for Uncertainties in Income Taxes

We account for uncertainties in income taxes according to accounting standards for uncertain tax positions.

We are present in a large number of taxable jurisdictions, and at any point in time, can have audits underway at

various stages of completion in any of these jurisdictions. We evaluate our tax positions and establish liabilities

83