Sears 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

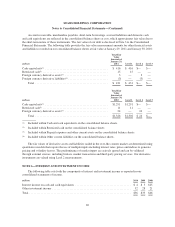

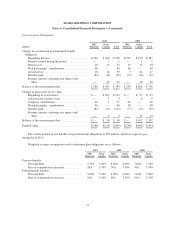

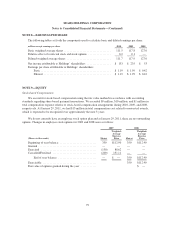

Sears Canada plan assets were invested in the following classes of securities (none of which were securities

of the Company):

Plan Assets at

January 29,

2011

January 30,

2010

Equity securities ......................................................... 28% 20%

Fixed income and other debt securities ........................................ 64 48

Alternative investments securities ........................................... 8 32

Total .................................................................. 100% 100%

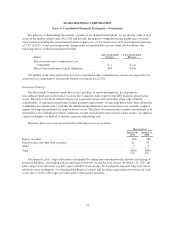

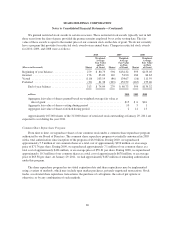

The Sears Canada plans’ target allocation is determined by taking into consideration the amounts and timing

of projected liabilities, our funding policies and expected returns on various asset classes. At January 29, 2011,

the plan’s target asset allocation was 60% fixed income and 40% equity. To develop the expected long-term rate

of return on assets assumption, we considered the historical returns and the future expectations for returns for

each asset class, as well as the target asset allocation of the pension portfolio.

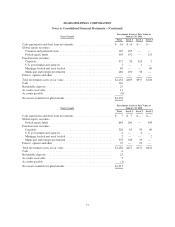

Future Cash Flows of Benefit Plans

Information regarding expected future cash flows for our benefit plans is as follows:

millions

SHC

Domestic

Sears

Canada Total

Pension benefits:

Employer contributions:

2011 (expected) .............................................. $ 343 $ 9 $ 352

Expected benefit payments:

2011 ........................................................... $ 337 $ 87 $ 424

2012 ........................................................... 346 88 434

2013 ........................................................... 356 89 445

2014 ........................................................... 366 90 456

2015 ........................................................... 377 91 468

2016-2020 ...................................................... 2,007 466 2,473

Postretirement benefits:

Employer contributions:

2011 (expected) .............................................. $ 36 $ 1 $ 37

Expected employer contribution for benefit payments:

2011 ........................................................... $ 36 $ 19 $ 55

2012 ........................................................... 34 20 54

2013 ........................................................... 32 20 52

2014 ........................................................... 30 21 51

2015 ........................................................... 28 21 49

2016-2020 ...................................................... 114 108 222

75