Sears 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

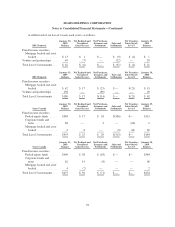

Notes to Consolidated Financial Statements—(Continued)

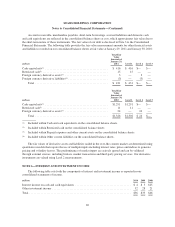

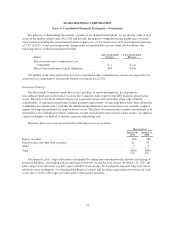

Financial Guarantees

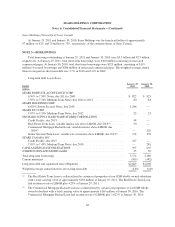

We issue various types of guarantees in the normal course of business. We had the following guarantees

outstanding at January 29, 2011:

millions

Bank

Issued

SRAC

Issued Other Total

Standby letters of credit .............................................. $405 $ 66 $— $471

Commercial letters of credit ........................................... 9 118 — 127

Secondary lease obligations ........................................... — — 20 20

The secondary lease obligations relate to certain store leases of previously divested Sears businesses and

certain Sears franchise locations. We remain secondarily liable if the primary obligor defaults.

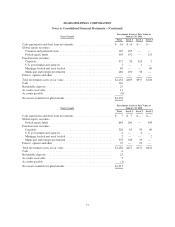

NOTE 5—FAIR VALUE OF FINANCIAL ASSETS AND LIABILITIES

We determine fair value of financial assets and liabilities based on the following fair value hierarchy, which

prioritizes the inputs to valuation techniques used to measure fair value into three levels:

Level 1 inputs—unadjusted quoted prices in active markets for identical assets or liabilities that we have

the ability to access. An active market for the asset or liability is one in which transactions for the asset or

liability occur with sufficient frequency and volume to provide ongoing pricing information.

Level 2 inputs—inputs other than quoted market prices included in Level 1 that are observable, either

directly or indirectly, for the asset or liability. Level 2 inputs include, but are not limited to, quoted prices

for similar assets or liabilities in an active market, quoted prices for identical or similar assets or liabilities in

markets that are not active and inputs other than quoted market prices that are observable for the asset or

liability, such as interest rate curves and yield curves observable at commonly quoted intervals, volatilities,

credit risk and default rates.

Level 3 inputs—unobservable inputs for the asset or liability.

68