Sears 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

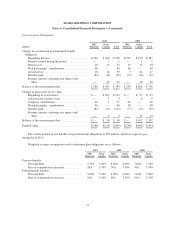

(3) The Senior Secured Term Loan is collateralized by a priority interest in all non-real estate assets of OSH

and a second lien on OSH’s inventory, and requires quarterly repayments equal to 0.25% of the then

outstanding principal balance. The Senior Secured Term Loan had an interest rate of LIBOR plus 4.75% at

January 29, 2011.

The fair value of long-term debt was $2.5 billion at January 29, 2011 and $1.4 billion at January 30, 2010.

The fair value of our debt was estimated based on quoted market prices for the same or similar issues or on

current rates offered to us for debt of the same remaining maturities.

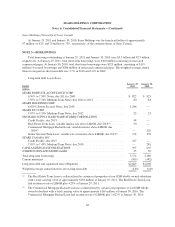

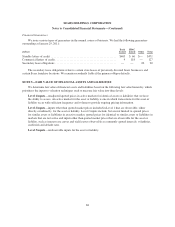

At January 29, 2011, long-term debt maturities for the next five years and thereafter were as follows:

millions

2011 .............................................................. $ 509

2012 .............................................................. 235

2013 .............................................................. 329

2014 .............................................................. 58

2015 .............................................................. 160

Thereafter .......................................................... 1,881

$3,172

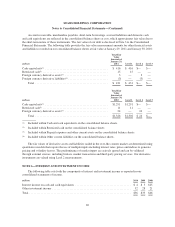

Interest

Interest expense for years 2010, 2009, and 2008 was as follows:

millions 2010 2009 2008

COMPONENTS OF INTEREST EXPENSE

Interest expense ................................................. $258 $219 $243

Accretion of lease obligations at net present value ...................... 21 22 24

Amortization of debt issuance costs ................................. 31 24 5

Interest expense ................................................. $310 $265 $272

Debt Repurchase Authorization

In 2005, our Finance Committee of the Board of Directors authorized the repurchase, subject to market

conditions and other factors, of up to $500 million of our outstanding indebtedness in open market or privately

negotiated transactions. Our wholly owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has

repurchased $215 million of its outstanding notes, including $6 million repurchased during 2009 and $49 million

repurchased during 2008, thereby reducing the unused balance of this authorization to $285 million. We

recognized a gain of $13 million on the repurchases made during 2008.

Unsecured Commercial Paper

We borrow through the commercial paper markets. At January 29, 2011 and January 30, 2010, we had

outstanding commercial paper borrowings of $360 million and $206 million, respectively. ESL Investments, Inc.

held $240 million at January 29, 2011. See Note 16 for further discussion of these borrowings.

63