Sears 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

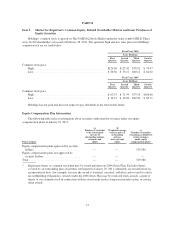

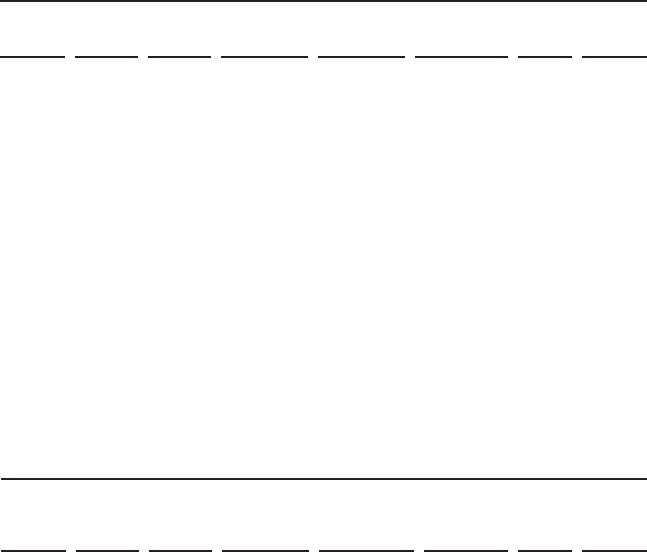

executive management team for these same items. Furthermore, we believe our use of GAAP measures “As

Adjusted,” including Diluted Income per Share “As Adjusted,” provides an appropriate measure to use in

assessing our performance across periods, given that this measure provides an adjustment for certain significant

items, the magnitude of which may vary significantly from period to period and, thereby, have a disproportionate

effect on the earnings we report for a given period. Accordingly, we consider the aggregate impact of these items,

along with reported results, in reviewing and evaluating our financial performance. However, we do not, and do

not recommend that you solely use GAAP measures “As Adjusted” to assess our financial performance or to

formulate investment decisions, as the measures may exclude a number of important cash and non-cash recurring

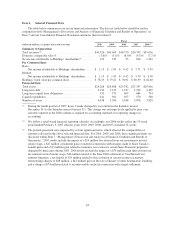

items. The following tables set forth results of operations on a GAAP and “As Adjusted” basis, as well as the

impact each significant item had on specific income and expense amounts reported in our Consolidated

Statements of Income during years 2010, 2009 and 2008.

Fiscal 2010 (Year ended January 29, 2011)

millions, except per share data GAAP

Domestic

Pension

Expense

Mark-to-

Market

Losses

Closed Store

Reserve and

Severance

Gain on Sale

of Real

Estate

Canadian

Dividend Tax

Impact

Tax

Matters

As

Adjusted

Cost of sales, buying and

occupancy impact ......... $31,448 $ — $ — $ (12) $ — $ — $ — $31,436

Selling and administrative

impact .................. 10,571 (120) — (14) — — — 10,437

Depreciation and amortization

impact .................. 900 — — (10) — — — 890

Gain on sales of assets

impact .................. (67) — — — 35 — — (32)

Operating income impact ..... 474 120 — 36 (35) — — 595

Other loss impact ........... (14) — 6 — — — — (8)

Income tax expense impact . . . (36) (24) (1) (6) 7 9 (13) (64)

Noncontrolling interest

impact .................. (17) — (1) — — — — (18)

After tax and noncontrolling

interest impact ........... 133 96 4 30 (28) 9 (13) 231

Diluted income per share

impact .................. $ 1.19 $0.86 $0.04 $0.27 $(0.25) $0.08 $(0.12) $ 2.07

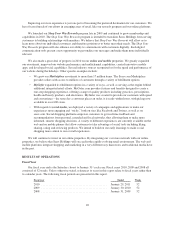

Fiscal 2009 (Year ended January 30, 2010)

millions, except per share data GAAP

Domestic

Pension

Expense

Mark-to-

Market

Gains

Closed Store

Reserve and

Severance

Gain on Sale

of Sears

Canada

Headquarters

Visa /

MasterCard

Settlement

Tax

Matters

As

Adjusted

Cost of sales, buying and

occupancy impact ......... $31,824 $ — $ — $ (37) $ — $ — $ — $31,787

Selling and administrative

impact .................. 10,654 (170) — (82) — 32 — 10,434

Depreciation and amortization

impact .................. 926 — — (12) — — — 914

Gain on sales of assets

impact .................. (74) — — — 44 — — (30)

Operating income impact ..... 713 170 — 131 (44) (32) — 938

Other loss impact ........... (61) — 33 — — — — (28)

Income tax expense impact . . . (123) (50) (8) (38) 10 10 (41) (240)

Noncontrolling interest

impact .................. (62) — (9) (3) 12 — — (62)

After tax and noncontrolling

interest impact ........... 235 120 16 90 (22) (22) (41) 376

Diluted income per share

impact .................. $ 1.99 $1.02 $0.14 $0.77 $(0.19) $(0.19) $(0.35) $ 3.19

22