Sears 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

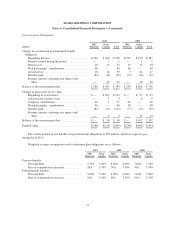

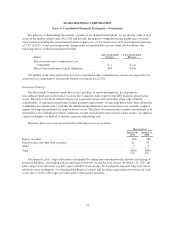

Notes to Consolidated Financial Statements—(Continued)

Sears Canada Credit Agreement

In September 2010, Sears Canada entered into a five-year, $800 million Canadian senior secured revolving

credit facility (the “Sears Canada Facility”). The Sears Canada Facility is available for Sears Canada’s general

corporate purposes and is secured by a first lien on substantially all of Sears Canada’s non-real estate assets.

Availability under the Sears Canada Facility is determined pursuant to a borrowing base formula based on

inventory and account and credit card receivables, subject to certain limitations.

At January 29, 2011, we had approximately $107 million ($108 million Canadian) of borrowings

outstanding under the Sears Canada Facility and classified these borrowings as long-term debt as we do not

intend to repay outstanding amounts within the next twelve months. Availability under this agreement, given

total outstanding borrowings and letters of credit, was approximately $510 million ($511 million Canadian) at

January 29, 2011.

Letters of Credit Facility

On January 20, 2011, we and certain of our subsidiaries entered into a letter of credit facility (the “LC

Facility”) with Wells Fargo Bank, National Association (“Wells Fargo”), pursuant to which Wells Fargo may, on

a discretionary basis and with no commitment, agree to issue standby letters of credit upon our request in an

aggregate amount not to exceed $500 million for general corporate purposes. The letters of credit issued under

the LC Facility are secured by a first priority lien on cash placed on deposit at Wells Fargo pursuant to a pledge

and security agreement in an amount equal to 103% of the face value of all issued and outstanding letters of

credit. The LC Facility has a term ending on January 20, 2014, unless terminated sooner pursuant to its terms.

Wells Fargo may, in it sole discretion, terminate the LC Facility at any time.

The LC Facility enables us to more cost-effectively obtain letters of credit when surplus cash is available to

collateralize the letters of credit. On January 29, 2011, $150 million of letters of credit were outstanding from the

facility. We may replace our letters of credit issued under our LC Facility with letters of credit issued under the

Domestic Credit Facility in the future and as such, cash collateral is considered unrestricted cash.

Cash Collateral

We post cash collateral for certain self-insurance programs. We continue to classify the cash collateral

posted for self-insurance programs as cash and cash equivalents due to our ability to substitute letters of credit for

the cash at any time at our discretion. At January 29, 2011 and January 30, 2010, $325 million and $9 million of

cash, respectively, was posted as collateral for self-insurance programs.

Orchard Supply Hardware LLC (“OSH LLC”) Credit Agreement

In November 2005, OSH LLC entered into a five-year, $130 million senior secured revolving credit facility

(the “OSH LLC Facility”), which includes a $25 million letter of credit sublimit. The OSH LLC Facility was

amended and extended in January 2010 and, as a result, available capacity was bifurcated into a $100 million

tranche maturing December 2013 and a $20 million tranche maturing December 2011. The OSH LLC Facility

continues to have a $25 million letter of credit sublimit. The OSH LLC Facility is available for OSH LLC’s

general corporate purposes and is secured by a first lien on substantially all of OSH LLC’s non-real estate assets.

Availability under the OSH LLC Facility is determined pursuant to a borrowing base formula based on inventory

and account and credit card receivables, subject to certain limitations. At January 29, 2011, there were $48

million borrowings outstanding under the OSH LLC Facility and $7 million in outstanding letters of credit.

OSH LLC Real Estate Secured Term Loan

During the third quarter of 2010, OSH LLC repaid the $120 million CMBS Loan in its entirety through a

combination of available cash, borrowing on the OSH LLC Facility and entering into a new $50 million real

estate secured term loan with a variable interest rate above LIBOR and a due date of 2013.

65