Sears 2010 Annual Report Download - page 26

Download and view the complete annual report

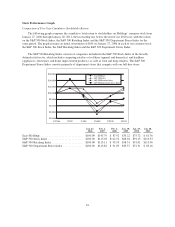

Please find page 26 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Margin

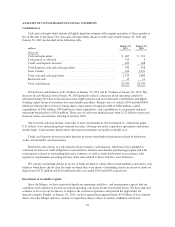

We generated $12.2 billion in gross margin in 2009 and $12.7 billion in 2008. The total decline of $433

million primarily reflects the impact of lower overall sales on our gross margin and includes a $50 million

decline related to the impact of foreign currency exchange rates on gross margin at Sears Canada. Our gross

margin was also impacted by charges of $37 million and $36 million recorded in cost of sales for margin related

expenses taken in connection with store closings announced during 2009 and 2008, respectively.

While gross margin dollars declined, our margin rate increased 60 basis points to 27.7% in 2009 from

27.1% for 2008. The increase was a result of improvements in margin rate of 110 basis points at Sears Domestic,

20 basis points at Kmart, and 90 basis points at Sears Canada. Increases in our margin rate stem from

improvements in merchandise cost and reduced clearance markdowns as a result of better inventory

management.

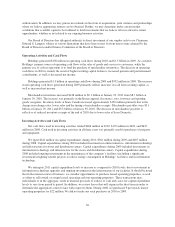

Selling and Administrative Expenses

Our selling and administrative expenses decreased $406 million in 2009 to $10.7 billion, with the decrease

mainly reflecting our focus on controlling costs given the economic environment. The decrease includes a $187

million reduction in payroll and benefits expense, a $180 million reduction in advertising expense, a $53 million

reduction in insurance expense, and a decrease of $27 million related to the impact of foreign currency exchange

rates. Selling and administrative expenses for 2009 were impacted by domestic pension plan expense of $170

million and store closing costs and severance of $82 million, partially offset by a gain of $32 million recorded in

connection with the settlement of Visa/MasterCard antitrust litigation. Selling and administrative expenses for

2008 were impacted by a $41 million charge related to store closing and severance, as well as the positive impact

of the reversal of a $62 million reserve because of a favorable verdict in connection with a legal settlement.

Selling and administrative expenses as a percentage of total revenues (“selling and administrative expense

rate”) were 24.2% for 2009 and 23.6% for 2008. The increase in our selling and administrative expense rate is

primarily the result of the above noted significant items, as well as lower expense leverage given lower overall

sales.

Depreciation and Amortization

Depreciation and amortization expense decreased by $55 million during 2009 to $926 million. The decrease

is primarily attributable to having fewer assets available for depreciation.

Impairment Charges

We recorded impairment charges of $360 million during 2008 related to impairment of goodwill and long-

lived assets. We did not record any such impairments in 2009. Impairment charges recorded during 2008 are

further described in Note 14 in Notes to Consolidated Financial Statements.

Gain on Sales of Assets

We recorded a total gain on the sales of assets of $74 million during 2009 and $51 million in 2008. The

increase in gains on sales of assets was due to a $44 million gain recognized by Sears Canada on the sale of its

former headquarters, as well as $13 million related to the sale of pharmacy lists for Kmart stores closed during

the year. Gains on sales of assets in 2008 included a $32 million gain on the sale of Sears Canada’s Calgary

downtown full-line store.

Sears Canada sold its headquarters office building and adjacent land in Toronto, Ontario in August 2007.

Sears Canada leased back the property under a leaseback agreement through March 2009, at which time it

finished its relocation of all head office operations to previously underutilized space in the Toronto Eaton Centre,

Ontario. Given the terms of the leaseback, for accounting purposes, the excess of proceeds received over the

carrying value of the associated property was deferred, and the resulting gain was recognized when Sears Canada

no longer occupied the associated property.

26