Sears 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Bankruptcy-Related Settlements

In 2008, we recognized recoveries of $5 million from vendors who had received cash payments for

pre-petition obligations (“critical vendor claims”) or preference payments. During 2008, the Company received

126,385 shares of common stock (weighted average price of $94.61 per share) with an approximate value of

$12 million from the Class 5 distribution referenced above. Of this amount, $5 million was recognized as a

recovery gain in other income, as they relate to recoveries from vendors who had received cash payments for

pre-petition obligations (critical vendor claims) or preference payments. The remaining $7 million was recorded

as capital in excess of par value, as these shares are the result of a 2004 transaction in which the Company

entered into settlement agreements with past providers of surety bonds to resolve all issues in connection with

their pre-petition claims. In accordance with the terms of the settlement agreements, Kmart assumed

responsibility for the future obligations under the bonds issued with respect to the Predecessor Company’s

workers’ compensation insurance program and was assigned the Class 5 claims against the Company.

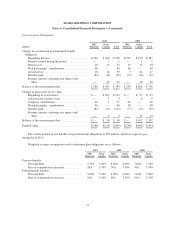

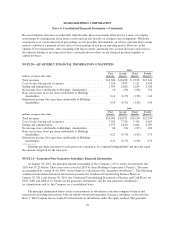

NOTE 11—INCOME TAXES

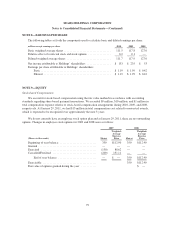

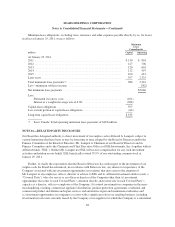

millions 2010 2009 2008

Income (loss) before income taxes

U.S. .................................................................. $(137) $ (38) $ (407)

Foreign ............................................................... 323 458 591

Total ............................................................. $ 186 $420 $ 184

Income tax expense (benefit)

Current:

Federal ............................................................ $ 11 $(179) $ (70)

State and local ...................................................... (4) 18 32

Foreign ........................................................... 110 141 199

Total ................................................................. 117 (20) 161

Deferred:

Federal ............................................................ (87) 124 (60)

State and local ...................................................... 6 21 (11)

Foreign ........................................................... — (2) (5)

(81) 143 (76)

Total ................................................................. $ 36 $123 $ 85

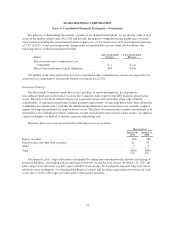

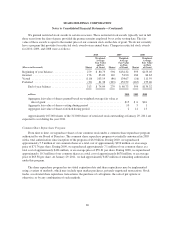

2010 2009 2008

Effective tax rate reconciliation

Federal income tax rate ................................................... 35.0% 35.0% 35.0%

State and local taxes net of federal tax benefit ................................. 0.7 6.0 7.2

Tax credits ............................................................. (11.7) (3.0) (6.3)

Resolution of income tax matters ........................................... (8.2) (6.2) (6.8)

Canadian repatriation cost on Sears Canada dividend received .................... 4.7 — —

Canadian rate differential on noncontrolling interest ............................ (0.1) (0.9) (2.3)

Basis difference in domestic subsidiary ...................................... — — (30.2)

Nondeductible goodwill .................................................. — — 50.0

Other ................................................................. (1.0) (1.6) (0.4)

19.4% 29.3% 46.2%

82