Sears 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Shrinkage is estimated as a percentage of sales for the period from the date of the last physical inventory to

the end of the year. Physical inventories are taken annually for all stores and inventory records are adjusted

accordingly. The shrinkage rate from the most recent physical inventory, in combination with historical

experience, is used as the basis for the shrinkage accrual following the physical inventory.

Self Insurance Reserves

We use a combination of third-party insurance and/or self-insurance for a number of risks including

workers’ compensation, asbestos and environmental, automobile, warranty, product and general liability claims.

General liability costs relate primarily to litigation that arises from store operations. Self-insurance reserves

include actuarial estimates of both claims filed and carried at their expected ultimate settlement value and claims

incurred but not yet reported. Our estimated claim amounts are discounted using a rate with a duration that

approximates the duration of our self-insurance reserve portfolio. Our liability reflected on the consolidated

balance sheets represents an estimate of the ultimate cost of claims incurred at the balance sheet date. In

estimating this liability, we utilize loss development factors based on Company-specific data to project the future

development of incurred losses. Loss estimates are adjusted based upon actual claims settlements and reported

claims. These projections are subject to a high degree of variability based upon future inflation rates, litigation

trends, legal interpretations, benefit level changes and claim settlement patterns. Although we do not expect the

amounts ultimately paid to differ significantly from our estimates, self-insurance reserves could be affected if

future claim experience differs significantly from the historical trends and the actuarial assumptions.

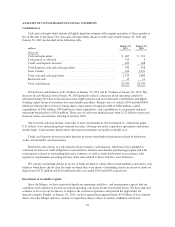

Defined Benefit Retirement Plans

The fundamental components of accounting for defined benefit retirement plans consist of the compensation

cost of the benefits earned, the interest cost from deferring payment of those benefits into the future and the

results of investing any assets set aside to fund the obligation. Such retirement benefits were earned by associates

ratably over their service careers. Therefore, the amounts reported in the income statement for these retirement

plans have historically followed the same pattern. Accordingly, changes in the obligations or the value of assets

to fund them have been recognized systematically and gradually over the associate’s estimated period of service.

The largest drivers of losses in recent years have been the discount rate used to determine the present value of the

obligation and the actual return on pension assets. We recognize the changes by amortizing experience gains/

losses in excess of the 10% corridor into expense over the associate service period and by recognizing the

difference between actual and expected asset returns over a five-year period.

Holdings’ actuarial valuations utilize key assumptions including discount rates and expected returns on plan

assets. We are required to consider current market conditions, including changes in interest rates and plan asset

investment returns, in determining these assumptions. Actuarial assumptions may differ materially from actual

results due to changing market and economic conditions, changes in investment strategies, higher or lower

withdrawal rates, and longer or shorter life spans of participants.

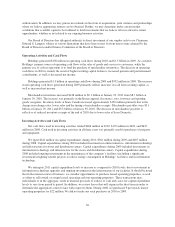

Income Taxes

We account for income taxes according to accounting standards for such taxes. Deferred tax assets and

liabilities are recognized for the future tax consequences attributable to differences between the book basis and

tax basis of assets and liabilities. Deferred tax assets and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be recovered or

settled. If future utilization of deferred tax assets is uncertain, the Company may record a valuation allowance

against certain deferred tax assets.

In accordance with accounting standards for uncertain tax positions, we record unrecognized tax benefits for

positions taken or expected to be taken on tax returns, including the decision to exclude certain income or

transactions from a return, when a more-likely-than-not threshold is met for a tax position and management

43