Sears 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

As of fiscal year end 2006, the Internal Revenue Service had completed its examination of Kmart’s and

Sears’ federal income tax returns through fiscal 2004 and 2003, respectively.

NOTE 15—REAL ESTATE TRANSACTIONS

Gain on Sale of Assets

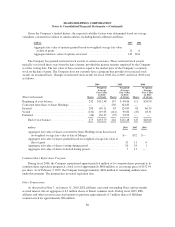

The Company recognized $82 million, $39 million, and $946 million in gains on sales of assets during fiscal

2006, fiscal 2005, and fiscal 2004, respectively. These gains were primarily a function of several large real estate

transactions. During fiscal 2006, the gain on sale of assets included a $41 million pre-tax gain on the sale of the

Company’s former Kmart corporate headquarters.

During fiscal 2004, the Company entered into multiple agreements with Home Depot U.S.A., Inc. (a

subsidiary of The Home Depot, Inc.) to sell four properties and assign 14 leased properties for an aggregate

purchase price of $271 million, resulting in a pre-tax gain of $253 million. Also during fiscal 2004, Kmart agreed

to sell four owned properties, assign 45 leased properties and lease one owned store to Sears for a total purchase

price of approximately $576 million, resulting in a pre-tax gain of $599 million.

Property held for sale at February 3, 2007 and January 28, 2006 was $0 million and $17 million,

respectively, and is included in other current assets in the accompanying consolidated balance sheets.

Property Acquisitions

During fiscal 2006, fiscal 2005, and fiscal 2004, the Company purchased 8, 19 and 31 previously leased

operating properties for $26 million, $98 million, and $124 million, respectively. In the normal course of

business, the Company considers opportunities to purchase leased operating properties, as well as offers to sell

owned, or assign leased, operating and non-operating properties. These transactions may, individually or in the

aggregate, result in material proceeds or outlays of cash. In addition, the Company reviews leases that will expire

in the short-term in order to determine the appropriate action to take with respect to them.

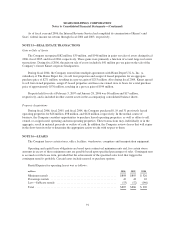

NOTE 16—LEASES

The Company leases certain stores, office facilities, warehouses, computers and transportation equipment.

Operating and capital lease obligations are based upon contractual minimum rents and, for certain stores,

amounts in excess of these minimum rents are payable based upon specified percentages of sales. Contingent rent

is accrued over the lease term, provided that the achievement of the specified sales level that triggers the

contingent rental is probable. Certain leases include renewal or purchase options.

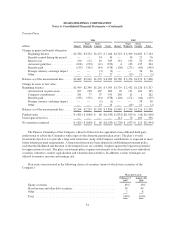

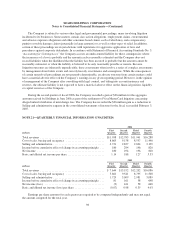

Rental Expense for operating leases was as follows:

millions 2006 2005 2004

Minimum rentals ............................................... $898 $895 $ 526

Percentage rentals .............................................. 42 43 10

Less—Sublease rentals .......................................... (53) (52) (146)

Total ......................................................... $887 $886 $ 390

91