Sears 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

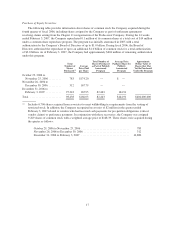

(1) Represents shares of common stock that may be issued pursuant to the Company’s 2006 Stock Plan.

Excludes shares covered by a plan award that are not delivered on an unrestricted basis (for example,

because the award is forfeited, canceled, settled in cash or used to satisfy tax withholding obligations).

Awards under the 2006 Stock Plan may be restricted stock awards, a grant of shares of the Company’s

common stock in connection with an award made under a long-term incentive plan, or certain other awards.

(2) Represents (1) a grant to Aylwin B. Lewis of options to purchase 150,000 shares of Holdings common stock

and (2) a grant to Alan J. Lacy, former Vice Chairman of Sears Holdings, of options to purchase 200,000

shares of Holdings common stock. On October 18, 2004, Kmart granted Mr. Lewis options to purchase

150,000 shares of Kmart common stock, subject to approval by Kmart’s stockholders. Kmart’s stockholders

approved the option grant on March 24, 2005, and these options were converted into options to purchase an

equal number of shares of Holdings common stock upon effectiveness of the Merger. The grant to Mr. Lacy

was approved by Kmart, the sole stockholder of Holdings on November 16, 2004, in connection with the

approval of Mr. Lacy’s employment agreement pursuant to which the options were granted.

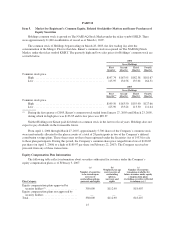

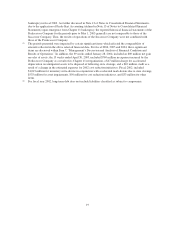

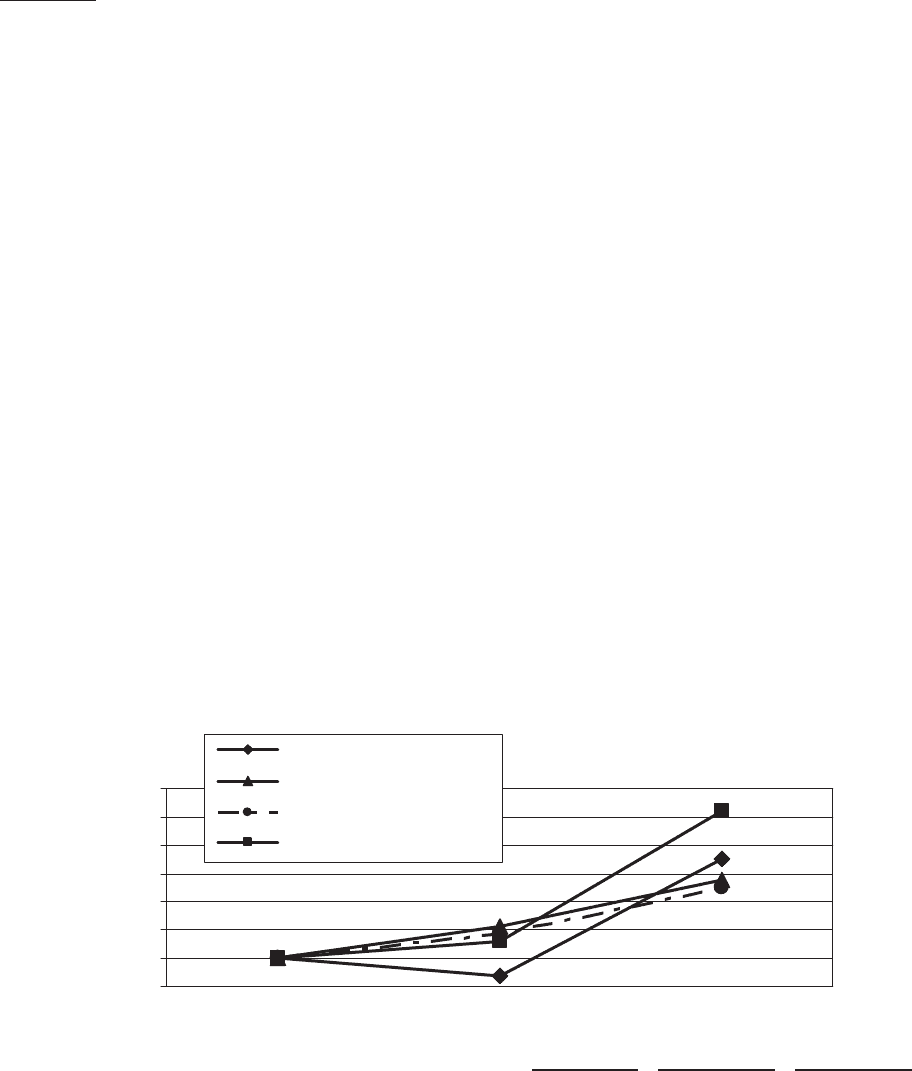

Stock Performance Graph

Comparison of Cumulative Stockholder Return—Value of $100 Invested March 28, 2005

The following graph compares the cumulative total return to stockholders on Holdings common stock from

March 28, 2005, the first day of trading of the Company’s common stock after the Merger, through February 2,

2007, the last trading day before the end of the Company’s 2006 fiscal year, with the return on the S&P 500

Stock Index, the S&P 500 Retailing Index and the S&P 500 Department Stores Index for the same period. The

graph assumes an initial investment of $100 on March 28, 2005 in each of the Company’s common stock, the

S&P 500 Stock Index, the S&P Retailing Index and the S&P 500 Department Stores Index.

The S&P 500 Retailing Index consists of companies included in the S&P 500 Stock Index in the broadly

defined retail sector, which includes competing retailers of softlines (apparel and domestics) and hardlines

(appliances, electronics and home improvement products), as well as food and drug retailers. The S&P 500

Department Stores Index consists primarily of department stores that compete with the Company’s full-line

stores.

$90.00

$100.00

$110.00

$120.00

$130.00

$140.00

$150.00

$160.00

700260025002

Sears Holdings

S&P 500 Index

S&P 500 Retailing Index

S&P Department Stores Index

March 28, 2005 January 27, 2006 February 2, 2007

Sears Holdings ....................................... $100.00 $ 93.96 $135.10

S&P 500 Index ...................................... $100.00 $110.99 $127.67

S&P 500 Retailing Index ............................... $100.00 $108.74 $125.17

S&P Department Stores Index .......................... $100.00 $105.71 $152.02

16