Sears 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

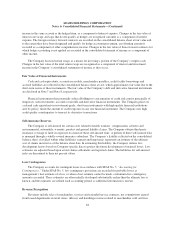

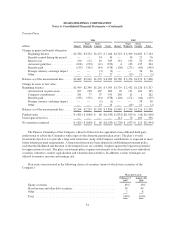

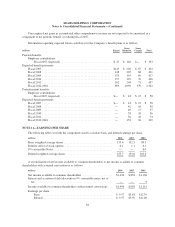

As of February 3, 2007, long-term debt maturities for the next five years and thereafter were as follows:

millions

2007 .............................................................. $ 613

2008 .............................................................. 356

2009 .............................................................. 376

2010 .............................................................. 566

2011 and thereafter ................................................... 1,551

$3,462

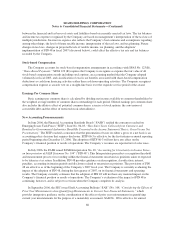

Interest

millions 2006 2005 2004

COMPONENTS OF INTEREST EXPENSE

Interest expense ................................................. $283 $236 $ 53

Accretion of obligations at net present value .......................... 45 62 50

Amortization of debt issuance costs ................................. 9 8 34

Accretion of debt discount on 9% convertible note ..................... — 17 9

Interest expense ................................................. $337 $323 $146

Debt Repurchase Authorization

In fiscal 2005, the Finance Committee of the Board of Directors of the Company authorized the repurchase,

subject to market conditions and other factors, of up to $500 million of the outstanding indebtedness of the

Company and its subsidiaries in open market or privately negotiated transactions. The Company’s wholly-owned

finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has repurchased $158 million of its outstanding

notes, including $2 million repurchased during fiscal 2006, thereby reducing the unused balance of this

authorization to $342 million.

Credit Agreement

The Company’s $4.0 billion, five-year credit agreement (the “Credit Agreement”) has an expiration date of

March 2010 and is available for general corporate purposes and includes a $1.5 billion letter of credit sublimit.

The Credit Agreement is a revolving credit facility under which SRAC and Kmart Corporation are the borrowers.

The Credit Agreement is guaranteed by Holdings and certain of its direct and indirect subsidiaries and is secured

by a first lien on domestic inventory, credit card accounts receivable and the proceeds thereof. Availability under

the Credit Agreement is determined pursuant to a borrowing base formula, based on domestic inventory, subject

to certain limitations. As of February 3, 2007 and January 28, 2006, the Company had $196 million and $428

million of letters of credit outstanding under the Credit Agreement, respectively, with $3.8 billion and $3.6

billion, respectively, of availability remaining under the Credit Agreement. There were no direct borrowings

under the facility during either fiscal 2006 or fiscal 2005. The Credit Agreement does not contain provisions that

would restrict borrowings or letter of credit issuances based on material adverse changes or credit ratings.

The Company’s previous credit agreement (the “Credit Facility”) was an $800 million revolving credit

facility with an equivalent letter of credit sub-limit. In fiscal 2004, the Company reduced the size of the Credit

Facility, and effective January 3, 2005, the Company voluntarily terminated the Credit Facility. In conjunction

with these actions, the Company accelerated the amortization of $23 million in associated debt issuance costs.

From its inception, the Credit Facility was used only to support outstanding letters of credit.

74