Sears 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

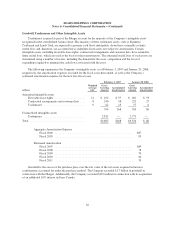

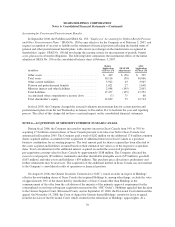

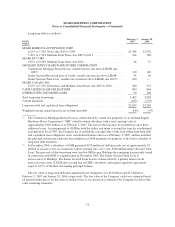

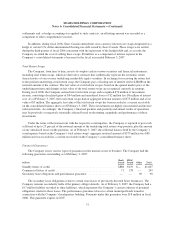

Accounting for Pension and Postretirement Benefits

In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans.” SFAS No. 158 became effective for the Company as of February 3, 2007, and

requires recognition of an asset or liability in the statement of financial position reflecting the funded status of

pension and other postretirement benefit plans, with current-year changes in the funded status recognized in

shareholders’ equity. SFAS No. 158 did not change the existing criteria for measurement of periodic benefit

costs, plan assets or benefit obligations. The following table summarizes the incremental effects of the initial

adoption of SFAS No. 158 on the consolidated balance sheet at February 3, 2007.

In millions

Before

Application

of SFAS 158

SFAS 158

Adjustments

After

Application

of SFAS 158

Other assets ...................................... $ 449 $ (50) $ 399

Total assets ....................................... 30,116 (50) 30,066

Other current liabilities ............................. 3,922 43 3,965

Pension and postretirement benefits ................... 1,621 27 1,648

Minority interest and other liabilities ................... 2,998 (195) 2,803

Total liabilities .................................... 17,477 (125) 17,352

Accumulated other comprehensive income (loss) ......... (7) 75 68

Total shareholder’s equity ........................... 12,639 75 12,714

In fiscal 2005, the Company changed the actuarial valuation measurement date for certain pension and

postretirement plans from the last Wednesday in January to December 31st to facilitate the year-end reporting

process. The effect of this change did not have a material impact on the consolidated financial statements.

NOTE 4—ACQUISITION OF MINORITY INTEREST IN SEARS CANADA

During fiscal 2006, the Company increased its majority interest in Sears Canada from 54% to 70% by

acquiring 17.8 million common shares of Sears Canada pursuant to its take-over bid for Sears Canada, first

announced in December 2005. The Company paid a total of $282 million for the additional 17.8 million common

shares acquired and has accounted for the acquisition of additional interests in Sears Canada as a purchase

business combination for accounting purposes. The total amount paid for shares acquired has been allocated to

the assets acquired and liabilities assumed based on their estimated fair values as of the respective acquisition

dates. Total consideration for the additional interest acquired exceeded the associated proportionate

pre-acquisition carrying value for Sears Canada by approximately $188 million. The Company allocated the

excess to real property ($5 million), trademarks and other identifiable intangible assets ($55 million), goodwill

($167 million) and other assets and liabilities (-$39 million). This purchase price allocation is preliminary and

further refinements may be necessary. The acquisition of the additional interest in Sears Canada was not material

to the Company’s consolidated results of operations or financial position.

On August 8, 2006, the Ontario Securities Commission (“OSC”) issued an order in respect of Holdings’

offer for the outstanding shares of Sears Canada that required Holdings to, among other things, exclude the votes

of approximately 30% of the shares held by shareholders of Sears Canada other than Holdings at the

commencement of the offer from the calculation of the majority of the minority approval requirement for the

contemplated second step subsequent acquisition transaction (the “OSC Order”). Holdings appealed that decision

to the Ontario Superior Court (Divisional Court), and on September 19, 2006, the Divisional Court dismissed the

appeal. On November 14, 2006, the Court of Appeal for Ontario denied Holdings’ motion for leave to appeal

from the decision of the Divisional Court, which resulted in the exhaustion of Holdings’ appeal rights. At a

70