Sears 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

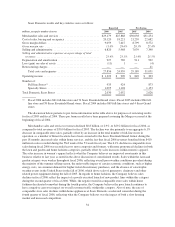

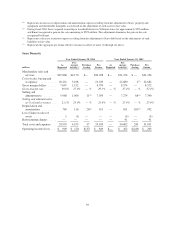

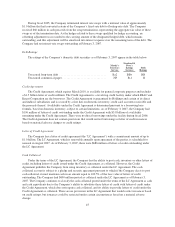

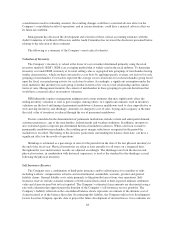

(4) Represents an increase in depreciation and amortization expense resulting from the adjustment to Sears’ property and

equipment and identifiable intangible assets based on the adjustment of such assets to fair value.

(5) During fiscal 2004, Sears acquired ownership or leasehold interest in 50 Kmart stores for approximately $576 million,

and Kmart recognized a gain on the sale amounting to $599 million. This adjustment eliminates the gain on the sale

recognized by Kmart.

(6) Represents a decrease to interest expense resulting from the adjustment to Sears debt based on the adjustments of such

liabilities to fair value.

(7) Represents the aggregate pro forma effective income tax effect of notes (2) through (6) above.

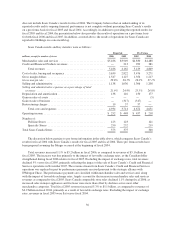

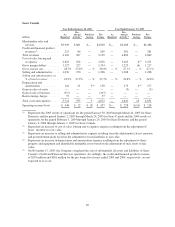

Sears Domestic

Year Ended January 28, 2006 Year Ended January 29, 2005

millions

As

Reported

Pre-

merger

Activity(1)

Purchase

Acctng

Pro

Forma

As

Reported

Pre-

merger

Activity(1)

Purchase

Acctng

Pro

Forma

Merchandise sales and

services .............. $25,868 $4,170 $— $30,038 $— $31,254 $ — $31,254

Cost of sales, buying and

occupancy ............ 18,221 3,018 — 21,239 — 22,680 2(2) 22,682

Gross margin dollars ...... 7,647 1,152 — 8,799 — 8,574 — 8,572

Gross margin rate ........ 29.6% 27.6% — % 29.3% — % 27.4% — % 27.4%

Selling and

administrative ......... 5,968 1,060 11(3) 7,039 — 7,274 66(3) 7,340

Selling and administrative

as % of total revenues ... 23.1% 25.4% — % 23.4% — % 27.4% — % 27.4%

Depreciation and

amortization ........... 769 116 26

(4) 911 — 811 181(4) 992

Loss (Gain) on sales of

assets ................ 1 (1) — — — (4) — (4)

Restructuring charges ..... — — — — — 41 — 41

Total costs and expenses . . . 24,959 4,193 37 29,189 — 30,802 249 31,051

Operating income (loss) .... $ 909 $ (23) $ (37) $ 849 $— $ 452 $(249) $ 203

39