Sears 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Operations, Consolidation and Basis of Presentation

Sears Holdings Corporation (“Holdings” or the “Company”) is the parent company of Kmart Holding

Corporation (“Kmart”) and Sears, Roebuck and Co. (“Sears”). Holdings was formed as a Delaware corporation

in 2004 in connection with the merger of Kmart and Sears (the “Merger”), which was completed on March 24,

2005. The Company is a broadline retailer with approximately 2,300 full-line and 1,100 specialty retail stores in

the United States operating through Kmart and Sears and approximately 370 full-line and specialty retail stores in

Canada operating through Sears Canada Inc. (“Sears Canada”), a 70%-owned subsidiary. The Company has three

reportable segments, Kmart, Sears Domestic and Sears Canada.

For accounting purposes, the Merger was treated as a purchase business combination, with Kmart acquiring

Sears. Accordingly, the historical financial statements of Kmart serve as the historical financial statements of

Holdings, the registrant. The results of Sears are included in the consolidated financial statements subsequent to

the Merger date. As a result, Holdings’ operating results for fiscal 2005 include approximately 44 weeks of

Sears’ results and 52 weeks of Kmart’s results. See Note 2 for summary unaudited pro forma information and

details on the purchase accounting applied to the Merger.

The consolidated financial statements include all majority-owned subsidiaries in which Holdings exercises

control. Investments in companies in which Holdings exercises significant influence, but which the Company

does not control (generally 20% to 50% ownership interest), are accounted for under the equity method of

accounting. Investments in companies in which the Company has less than a 20% ownership interest and does

not exercise significant influence are accounted for at cost. All intercompany transactions and balances have been

eliminated.

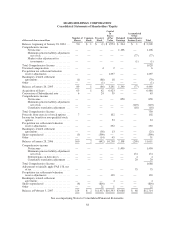

Fiscal Year

Effective March 23, 2005, the Company changed its fiscal year end from the last Wednesday in January to

the Saturday closest to January 31st. In fiscal 2006, the Saturday nearest January 31st was February 3, 2007.

Therefore, fiscal 2006 consisted of 53 weeks, with the additional week occurring in the fourth quarter. Both fiscal

2005 and fiscal 2004 consisted of 52 weeks. Unless otherwise stated, references to years in this report relate to

fiscal years rather than to calendar years. The following fiscal periods are presented in this report.

Fiscal year Reporting Entity Ended Weeks

2006 ............................. Sears Holdings Corporation February 3, 2007 53

2005 ............................. Sears Holdings Corporation January 28, 2006 52

2004 ............................. KmartHolding Corporation January 26, 2005 52

Sears Canada’s fiscal year end is the Saturday closest to December 31st. The results of operations for Sears

Canada are reported to Holdings on a one-month lag. Therefore, the consolidated statements of income and cash

flows for fiscal 2006 and fiscal 2005 include operating results for Sears Canada from January 1, 2006 through

December 30, 2006 and March 25, 2005 through December 31, 2005, respectively.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions about future events. The

estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the

59