Sears 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

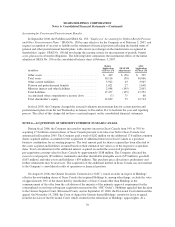

Selected Unaudited Pro Forma Combined Financial Information

The unaudited pro forma financial information in the table below summarizes the combined results of

operations of Kmart and Sears for fiscal 2005 as though the Merger had occurred as of the beginning of fiscal

2005. The unaudited pro forma financial information is presented for informational purposes only and is not

indicative of the results of operations that would have been achieved if the Merger had taken place at the

beginning of the period presented, or that may result in the future. In addition, Holdings is realizing operating

synergies as a result of the Merger. The following unaudited pro forma financial information has not been

adjusted to reflect any operating efficiencies realized as a result of the Merger.

millions, except earnings per share 2005

Revenues ......................................................... $54,261

Operating income ................................................... 2,073

Income before cumulative effect of change in accounting principle ............ 879

Net income ........................................................ 789

Diluted earnings per share before cumulative effect of change in accounting

principle ........................................................ $ 5.40

Diluted earnings per share ............................................ $ 4.85

NOTE 3—CHANGES IN ACCOUNTING PRINCIPLE

Accounting For Certain Indirect Buying, Warehousing and Distribution Costs

Effective January 27, 2005, the Company changed its method of accounting for certain indirect buying,

warehousing and distribution costs. Prior to this change, the Company had included indirect buying, warehousing

and distribution costs as inventoriable costs. Beginning in fiscal 2005, such costs have been expensed as incurred,

which is the method of accounting previously followed by Sears. The Company believes that this change

provides a better measurement of operating results in light of changes to the Company’s supply chain to realize

cost savings from the Merger, the closure of certain facilities and the combined capacity of the existing

distribution and headquarters facilities. In accordance with Accounting Principles Board Opinion (“APB”)

No. 20, “Accounting Changes,” changes in accounting policy to conform the acquirer’s policy to that of the

acquired entity are treated as a change in accounting principle. The indirect buying, warehousing and distribution

costs that were capitalized to inventory as of January 26, 2005 have been reflected in the fiscal 2005 consolidated

statement of income as a cumulative effect of a change in accounting principle in the amount of $90 million, net

of income taxes of $58 million.

69