Sears 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

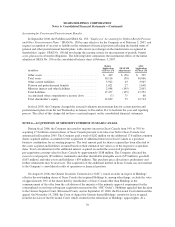

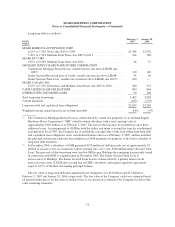

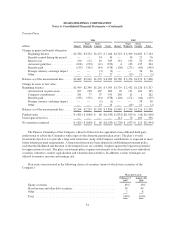

Long-term debt is as follows:

ISSUE

February 3,

2007

January 28,

2006

millions

SEARS ROEBUCK ACCEPTANCE CORP.

6.25% to 7.50% Notes, due 2007 to 2043 .................................. $1,398 $1,526

5.20% to 7.50% Medium-Term Notes, due 2007 to 2013 ..................... 414 588

SEARS DC CORP.

9.07% to 9.20% Medium-Term Notes, due 2012 ............................ 26 27

ORCHARD SUPPLY HARDWARE STORES CORPORATION

Commercial Mortgage-Backed Loan, variable interest rate above LIBOR, due

2007(1) ........................................................... 120 120

Senior Secured Revolving Line of Credit, variable interest rate above LIBOR ..... 34 56

Senior Secured Term Loan, variable rate of interest above LIBOR, due 2013(2) .... 200 —

SEARS CANADA INC.

6.55% to 7.45% Debentures and Medium-Term Notes, due 2007 to 2010 ........ 380 551

CAPITALIZED LEASE OBLIGATIONS ..................................... 800 864

OTHER NOTES AND MORTGAGES ....................................... 90 106

Total long-term borrowings ................................................ 3,462 3,838

Current maturities ........................................................ (613) (570)

Long-term debt and capitalized lease obligations ................................ $2,849 $3,268

Weighted-average annual interest rate on long-term debt ......................... 6.8% 5.9%

(1) The Commercial Mortgage-Backed Loan is collateralized by certain real properties of an Orchard Supply

Hardware Stores Corporation (“OSH”) wholly-owned subsidiary with a total carrying value of

approximately $185 million as of February 3, 2007. The term of the loan may be extended for up to three

additional years. As management of OSH has both the ability and intent to extend the term for an additional

year period in fiscal 2007, the Company has classified the carrying value of this loan within long-term debt

and capitalized lease obligations on its consolidated balance sheet as of February 3, 2007, and has included

the principal amount due under the loan within fiscal 2008 maturities for purposes of the below schedule of

long-term debt maturities.

(2) In December 2006, a subsidiary of OSH generated $198 million of debt proceeds, net of approximately $2

million in issuance costs, in connection with its entering into a five year, $200 million Senior Secured Term

Loan. The proceeds of this borrowing were used by OSH to pay Holdings the remaining loan payable issued

in connection with OSH’s recapitalization in November 2005. The Senior Secured Term Loan is

non-recourse to Holdings. The Senior Secured Term Loan is collateralized by a priority interest in all

non-real estate assets of OSH and a second lien on OSH’s inventory, and requires quarterly repayments

equal to 0.25% of the then outstanding principal balance.

The fair value of long-term debt and capitalized lease obligations was $2.8 billion and $3.2 billion at

February 3, 2007 and January 28, 2006, respectively. The fair value of the Company’s debt was estimated based

on quoted market prices for the same or similar issues or on current rates offered to the Company for debt of the

same remaining maturities.

73