Sears 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

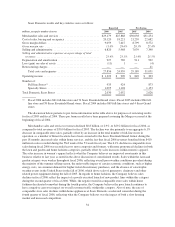

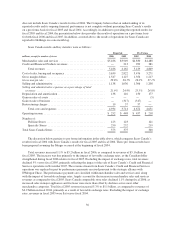

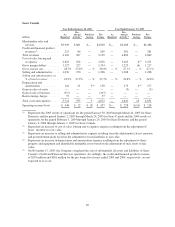

PRO FORMA RECONCILIATION

The following tables provide a reconciliation from the as reported results to the pro forma results presented

above for Sears Holdings for the years ended January 28, 2006 and January 26, 2005, respectively, as well as for

Sears Domestic and Sears Canada for the years ended January 28, 2006 and January 29, 2005, respectively.

Sears Holdings

Year Ended January 28, 2006 Year Ended January 26, 2005

millions, except per share data

As

Reported

Pre-

merger

Activity(1)

Purchase

Acctng

Pro

Forma

As

Reported

Pre-

merger

Activity(1)

Purchase

Acctng

Pro

Forma

Merchandise sales and services ..... $48,911 $5,051 $— $53,962 $19,843 $35,742 $ — $55,585

Credit and financial products

revenues ..................... 213 86 — 299 — 381 — 381

Total revenues .............. 49,124 5,137 — 54,261 19,843 36,123 — 55,966

Cost of sales, buying and

occupancy ................... 35,505 3,672 — 39,177 14,942 25,945 8(2) 40,895

Gross margin dollars ............. 13,406 1,379 — 14,785 4,901 9,797 (8) 14,690

Gross margin rate ............... 27.4% 27.3% — % 27.4% 24.7% 27.4% — % 26.4%

Selling and administrative ......... 10,808 1,330 11(3) 12,149 3,999 8,482 66(3) 12,547

Selling and administrative as % of

total revenues ................ 22.0% 25.9% — % 22.4% 20.2% 23.5% — % 22.4%

Depreciation and amortization ..... 932 147 29

(4) 1,108 27 984 185(4) 1,196

Gain on sales of assets ............ (39) (1) — (40) (946) (9) 599(5) (356)

Gain on sale of business .......... (317) — — (317) — — — —

Restructuring charges ............ 111 — — 111 — 41 — 41

Total costs and expenses .......... 47,000 5,148 40 52,188 18,022 35,443 858 54,323

Operating income (loss) .......... 2,124 (11) (40) 2,073 1,821 680 (858) 1,643

Interest and investment income ..... (127) (32) — (159) (41) (112) — (153)

Interest expense ................. 323 57 (2)

(6) 378 146 319 (23)(6) 442

Other income ................... (37) — — (37) (59) (8) — (67)

Income before income taxes,

minority interest and cumulative

effect of change in accounting

principle ..................... 1,965 (36) (38) 1,891 1,775 481 (835) 1,421

Income tax expense (benefit) ...... 716 4 (15)(7) 705 669 141 (319)(7) 491

Minority interest ................ 301 6 — 307 — 46 — 46

Income before cumulative effect of

change in accounting principle . . . 948 (46) (23) 879 1,106 294 (516) 884

Cumulative effect of change in

accounting principle, net of tax . . . (90) — — (90) — — — —

NET INCOME (LOSS) .......... $ 858 $ (46) $ (23) $ 789 $ 1,106 $ 294 $(516) $ 884

Diluted earnings per share before

cumulative effect of change in

accounting principle ........... $ 6.17 $ 5.40 $ 11.00 $ 5.40

Diluted earnings per share ......... $ 5.59 $ 4.85 $ 11.00 $ 5.40

(1) Represents the 2005 results of operations for the period January 30, 2005 through March 24, 2005 for Sears Domestic

and the period January 2, 2005 through March 24, 2005 for Sears Canada and the 2004 results of operations for the

period February 1, 2004 through January 29, 2005 for Sears Domestic and the period January 4, 2004 through January 1,

2005 for Sears Canada.

(2) Represents an increase to cost of sales, buying and occupancy expense resulting from the adjustment to Sears’ inventory

based on the adjustment of such assets to fair value.

(3) Represents an increase to selling and administrative expense resulting from the adjustment to Sears’ pension and

postretirement plans based on the adjustment of such liabilities to fair value.

38