Sears 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

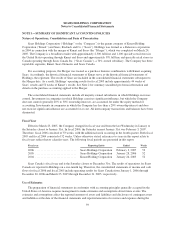

the composition of the governing body of the combined entity and the designation of certain senior management

positions. Accordingly, the historical financial statements of Kmart serve as the historical financial statements of

Holdings. The Company completed the purchase price allocation for the Merger during the first quarter of fiscal

2006. As a result, goodwill attributable to the Merger increased by approximately $37 million, primarily based

on the receipt of additional information regarding the fair values of certain properties and certain pre-acquisition

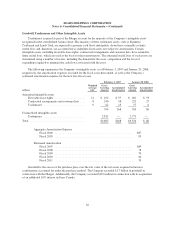

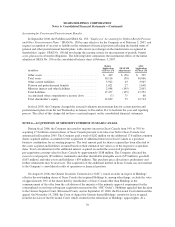

legal contingencies. The following summarizes the assets acquired and liabilities assumed as of the March 24,

2005 Merger date, based on the final purchase price allocation.

millions

Cash and cash equivalents ............................................ $ 4,351

Merchandise inventories ............................................. 6,134

Other current assets ................................................. 1,977

Land ............................................................. 2,023

Buildings and leasehold improvements .................................. 5,958

Furniture, fixtures and equipment ...................................... 1,750

Goodwill .......................................................... 1,721

Tradenames and other intangible assets .................................. 3,914

Other assets ....................................................... 475

Total assets acquired ............................................ 28,303

Merchandise payables and other current liabilities ......................... 6,784

Unearned revenues (including non-current portion) ........................ 1,896

Total debt and capitalized lease obligations ............................... 4,421

Deferred income taxes ............................................... 658

Pension and postretirement benefits ..................................... 1,647

Minority interest and other liabilities .................................... 1,035

Total liabilities assumed .......................................... 16,441

Net assets acquired .................................................. $11,862

The Company allocated approximately $3.9 billion to identifiable intangible assets, of which approximately

$2.8 billion related to the indefinite-lived tradenames of Sears, Kenmore, Craftsman, Lands’ End and DieHard.

These indefinite-lived tradenames are not subject to amortization as management expects these tradenames to

generate cash flows indefinitely. The remaining intangible assets of $1.1 billion recorded at the time of the

Merger included finite-lived tradenames, favorable leases, contractual arrangements and customer lists, and will

be amortized over their estimated useful lives. Approximately $0.4 billion of contractual-arrangement-related

intangibles were eliminated subsequent to the Merger in connection with the sale of Sears Canada’s Credit and

Financial Services Operations in November 2005.

68