Sears 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

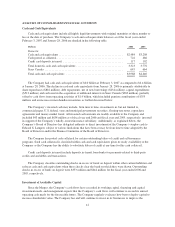

In November 2005, the Company received $59 million in cash from the investment by Ares Management

LLC (“Ares”) for 19.9% of the voting stock of OSH and receipt of a three-year option to purchase, for

$127 million, additional shares of OSH that represented 30.2% of OSH’s outstanding voting stock at the time of

the option’s issuance. Prior to the Ares investment, OSH was a wholly-owned subsidiary of the Company.

In addition, Holdings generated $169 million of debt proceeds, net of $7 million in issuance costs, in fiscal

2005 as a result of financing obtained by OSH subsidiaries concurrent with the Ares investment in 19.9% of the

voting stock of OSH. At the time of the Ares investment, OSH subsidiaries entered into a series of arrangements

for $250 million in financing, consisting of a $130 million senior secured revolving credit facility and a

$120 million commercial mortgage-backed loan. Approximately $56 million of the revolving credit facility was

drawn down at closing. A portion of the proceeds was used by OSH to fund a dividend to Holdings that included

$225 million in cash, which was available to be used for Holdings’ general corporate purposes.

Uses and Sources of Liquidity

The Company’s primary need for liquidity is to fund seasonal working capital requirements of its retail

businesses, capital expenditures and for general corporate purposes. The Company believes that these needs will

be adequately funded by the Company’s operating cash flows, credit terms from vendors, current balances in

cash and cash equivalents and, to the extent necessary, borrowings under the Company’s $4.0 billion, five-year

credit agreement (the “Credit Agreement”) (described below). At February 3, 2007, $3.8 billion was available

under this facility. While the Company expects to use the Credit Agreement as its primary funding source, it may

also access the public debt markets on an opportunistic basis. Additionally, the Company may from time to time

consider selective strategic transactions to create value and improve performance, which may include

acquisitions, dispositions, restructurings, joint ventures and partnerships. Transactions of these types may result

in material proceeds or cash outlays.

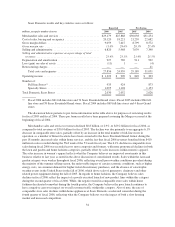

The Company’s year-end fiscal 2006 and 2005 outstanding borrowings were as follows:

millions

February 3,

2007

January 28,

2006

Short-term borrowings:

Unsecured commercial paper ................................. $ 94 $ 178

Long-term debt, including current portion:

Notes and debentures outstanding ............................. 2,662 2,974

Capital lease obligations ..................................... 800 864

Total borrowings ............................................... $3,556 $4,016

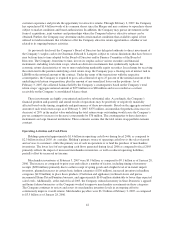

In fiscal 2005, the Finance Committee of the Company’s Board of Directors authorized the repurchase,

subject to market conditions and other factors, of up to $500 million of the outstanding indebtedness of the

Company and its subsidiaries in open market or privately negotiated transactions. The source of funds for the

purchases is expected to be the Company’s cash from operations or borrowings under the Credit Agreement. The

Company’s wholly-owned finance subsidiary, Sears Roebuck Acceptance Corp. (“SRAC”), has repurchased

$158 million of its outstanding notes, including $2 million repurchased during fiscal 2006, thereby reducing the

unused balance of this authorization to $342 million.

On January 31, 2005, Kmart entered into an agreement with Holdings and certain affiliates of

ESL Investments, Inc. (“ESL”). Pursuant to this agreement, ESL affiliates converted, in accordance with their

terms, all of the outstanding 9% convertible subordinated notes of Kmart and six months of accrued interest into

an aggregate of 6.3 million shares of Kmart common stock. In consideration of ESL’s conversion of the notes

prior to maturity, ESL received a $3 million payment from Kmart. The cash payment was equivalent to the

approximate discounted after-tax cost of the future interest payments that would have otherwise been paid by

Kmart to ESL and its affiliates in the absence of the early conversion. In conjunction with the conversion, the

Company recognized the remaining related unamortized debt discount of $17 million as interest expense.

44