Sears 2006 Annual Report Download - page 37

Download and view the complete annual report

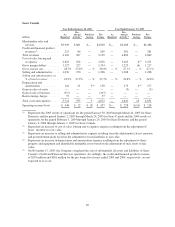

Please find page 37 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The gross margin rate for fiscal 2006 as compared to fiscal 2005 increased primarily due to the combined

effect of improved inventory management and less inventory shrinkage, as well as the favorable impact of a

stronger Canadian dollar on the cost of imported merchandise. These same factors primarily account for the

improved gross margin rate recorded in fiscal 2005 as compared to fiscal 2004.

The selling and administrative expense rate declined for fiscal 2006 as compared to fiscal 2005 primarily

due to the sale of Sears Canada’s Credit and Financial Services operations, the positive impact of productivity

initiatives initiated at Sears Canada in late fiscal 2005, and a reduction in marketing costs. The selling and

administrative expense rate for fiscal 2005 increased as compared to fiscal 2004 primarily due to increased

associate stock-based compensation and, to a lesser extent, increased marketing costs. The stock-based

compensation increase accounted for approximately 40 basis points of the total increase in the selling and

administrative expense rate in fiscal 2005 and resulted mainly from an increase in Sears Canada’s share price

subsequent to its announcement of a definitive agreement to sell substantially all assets and liabilities of its

Credit and Financial Services operations, as well as changes in Sears Canada’s associate stock plan to provide for

early vesting of unvested options and allow associates to take cash payments in lieu of shares.

Restructuring charges of $19 million and $57 million were recognized during fiscal 2006 and fiscal 2005,

respectively, in connection with the above-noted productivity initiatives.

Operating income was $252 million in fiscal 2006 as compared to $457 million in fiscal 2005. Fiscal 2005

operating income included a gain on sale of business totaling $317 million recorded to reflect the above-noted

minority interest gain on the sale of Sears Canada’s Credit and Financial Services business in November 2005.

Excluding this gain, operating income increased $112 million in fiscal 2006, as the impact of a decline in

revenues resulting from the sale of Sears Canada’s Credit and Financial Services operations was more than offset

by increased gross margin dollars and lower expenses, including $38 million less in restructuring expenses.

Operating income increased $239 million in fiscal 2005 as compared to fiscal 2004 due to the above-noted $317

million gain on sale of business. Excluding this gain, operating income declined $78 million in fiscal 2005 as

compared to fiscal 2004 due primarily to $57 million in restructuring charges recorded in fiscal 2005 and higher

selling and administrative expenses, partially offset by increased gross margin.

37