Sears 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

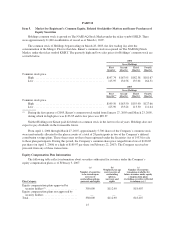

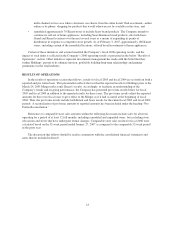

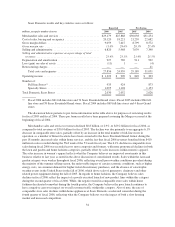

Holdings Reported Results

Holdings’ consolidated results of operations for fiscal 2006, 2005 and 2004, presented on both a reported

and a pro forma basis are summarized below.

Reported Pro Forma

2006 2005 2004 2005 2004

Merchandise sales and services ..................... $53,012 $48,911 $19,843 $53,962 $55,585

Credit and financial products revenues ............... — 213 — 299 381

Total revenues ............................... 53,012 49,124 19,843 54,261 55,966

Cost of sales, buying and occupancy ................. 37,820 35,505 14,942 39,177 40,895

Gross margin dollars .............................. 15,192 13,406 4,901 14,785 14,690

Gross margin rate ................................ 28.7% 27.4% 24.7% 27.4% 26.4%

Selling and administrative ......................... 11,581 10,808 3,999 12,149 12,547

Selling and administrative expense as a percentage of

total revenues ................................. 21.8% 22.0% 20.2% 22.4% 22.4%

Depreciation and amortization ...................... 1,142 932 27 1,108 1,196

Gain on sales of assets ............................ (82) (39) (946) (40) (356)

Gain on sale of business ........................... — (317) — (317) —

Restructuring charges ............................. 28 111 — 111 41

Total costs and expenses ....................... 50,489 47,000 18,022 52,188 54,323

Operating income ................................ 2,523 2,124 1,821 2,073 1,643

Interest and investment income ..................... (254) (127) (41) (159) (153)

Interest expense ................................. 337 323 146 378 442

Other income ................................... (24) (37) (59) (37) (67)

Income before income taxes, minority interest and

cumulative effect of change in accounting principle . . . 2,464 1,965 1,775 1,891 1,421

Income taxes .................................... 930 716 669 705 491

Minority interest ................................. 44 301 — 307 46

Income before cumulative effect of change in accounting

principle ..................................... 1,490 948 1,106 879 884

Cumulative effect of change in accounting principle, net

of tax(1) ...................................... — (90) — (90) —

NET INCOME ................................. $ 1,490 $ 858 $ 1,106 $ 789 $ 884

Diluted earnings per share before cumulative effect of

change in accounting principle .................... $ 9.57 $ 6.17 $ 11.00 $ 5.40 $ 5.40

Cumulative effect of change in accounting principle(1) . . . — (0.58) — (0.55) —

Diluted earnings per share ......................... $ 9.57 $ 5.59 $ 11.00 $ 4.85 $ 5.40

(1) Effective January 27, 2005, Kmart changed its method of accounting for certain indirect buying,

warehousing and distribution costs and, accordingly, the Company recorded the cumulative effect of this

change in accounting principle in fiscal 2005. Further information regarding this change in accounting is set

forth in Note 3 of Notes to Consolidated Financial Statements.

Fiscal 2006 Summary

The following discussion is designed to provide the reader with an overview of fiscal 2006 financial results,

with particular emphasis on significant events and transactions that had a disproportionate effect on the

Company’s results for the fiscal years presented. Further discussion regarding the Company’s operating

performance follows this overview section.

24