Sears 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

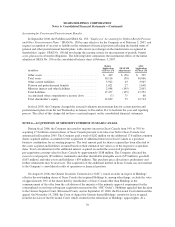

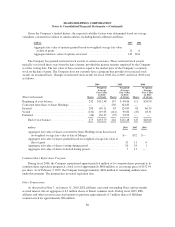

participants following retirement. The effect of this plan change, which was to reduce the projected benefit

obligation of the Sears domestic pension plan by approximately $80 million, has been recorded as a component

of purchase accounting.

In addition to providing pension benefits, Sears provides domestic and Canadian employees and retirees

certain medical benefits. Certain domestic Sears retirees are also provided life insurance benefits. The Company

shares the cost of the retiree medical benefits with retirees based on years of service. Generally, the Company’s

share of these benefit costs will be capped at Sears’ contribution calculated during the year of retirement. Sears’

postretirement benefit plans are not funded. The Company has the right to modify or terminate these plans.

Effective January 1, 2006, the Company eliminated its subsidization of retiree medical costs under the Sears

domestic retiree medical plan for those Sears retirees who were under age 65 as of December 31, 2005. The

effect of this plan change, which was to reduce the projected benefit obligation associated with the plan by

approximately $174 million, has been recorded as a component of purchase accounting.

Changes in Accounting for Pensions and Postretirement Plans

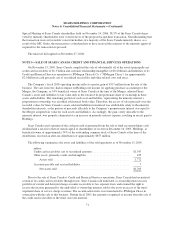

In September 2006, the FASB issued SFAS No. 158 which became effective for the Company as of

February 3, 2007, and requires recognition of an asset or liability in the statement of financial position reflecting

the funded status of pension and other postretirement benefit plans, with current-year changes in the funded

status recognized in stockholders’ equity. SFAS No. 158 did not change the existing criteria for measurement of

periodic benefit costs, plan assets or benefit obligations. See Note 3 for the incremental effects of the initial

adoption of SFAS No. 158 on the Company’s consolidated financial position at February 3, 2007.

In fiscal 2005, the Company changed the measurement date of its benefit programs from the last Wednesday

in January to December 31. The Company believes the one-month change of the measurement date is a

preferable change as it allows more time for management to plan and execute its review of the completeness and

accuracy of its benefit programs results. The change did not have a material effect on retained earnings as of

January 27, 2005, and income from continuing operations, net income, and related per share amounts for fiscal

2005. Accordingly, all amounts reported in the following tables for balances as of February 3, 2007 and

January 28, 2006 are based on a measurement date of December 31, 2006 and December 31, 2005, respectively.

Amounts reported in the following tables for balances as of January 26, 2005 are based on a measurement date of

January 26, 2005.

80