Sears 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Given the Company’s limited history, the expected volatility factors were determined based on average

volatilities calculated in relation to similar entities, including historical Kmart and Sears.

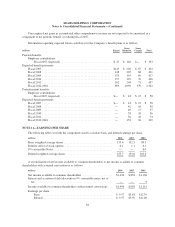

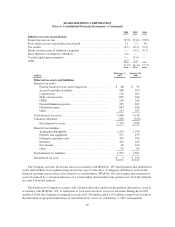

millions 2005 2004

Aggregate fair value of options granted based on weighted average fair value

at date of grant ................................................ 11 6

Aggregate intrinsic value of options exercised ......................... 145 N/A

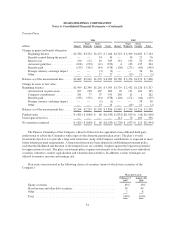

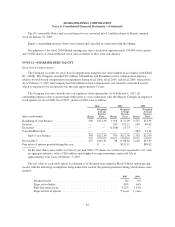

The Company has granted restricted stock awards to certain associates. These restricted stock awards

typically vest in full three years from the date of grant, provided the grantee remains employed by the Company

as of the vesting date. The fair value of these awards is equal to the market price of the Company’s common

stock on the date of grant. The Company does not currently have a program that provides for restricted stock

awards on an annual basis. Changes in restricted stock awards for fiscal 2006, fiscal 2005, and fiscal 2004 were

as follows:

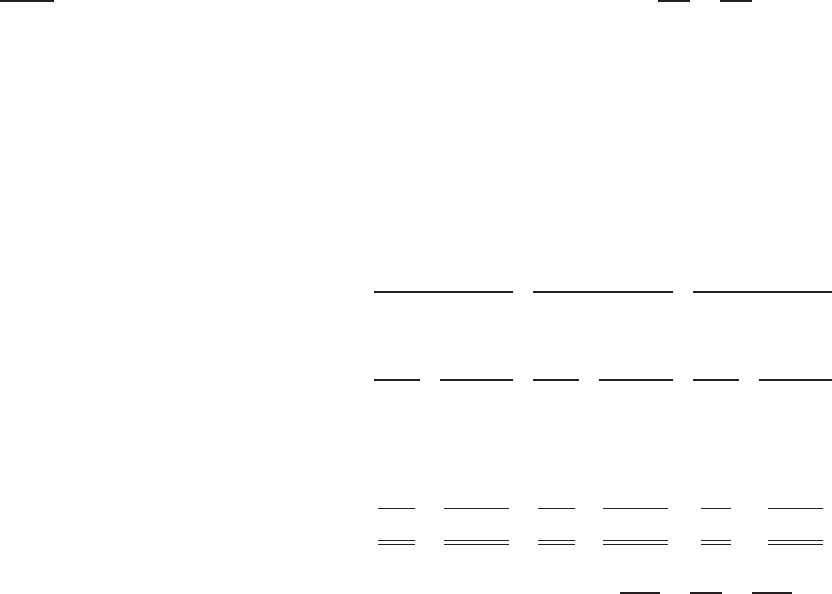

2006 2005 2004

(Shares in thousands) Shares

Weighted-

Average

Fair Value

on Date

of Grant Shares

Weighted-

Average

Fair Value

on Date

of Grant Shares

Weighted-

Average

Fair Value

on Date

of Grant

Beginning of year balance ...................... 242 $112.48 147 $ 48.66 111 $26.90

Converted from Sears to Sears Holdings ........... — — 250 124.83 — —

Granted .................................... 209 149.11 83 124.83 83 66.39

Vested ..................................... (132) 119.05 (141) 90.84 (47) 28.31

Forfeited .................................... (46) 136.37 (97) 94.93 — —

End of year balance ....................... 273 $133.79 242 $112.48 147 $48.66

millions 2006 2005 2004

Aggregate fair value of shares converted to Sears Holdings from Sears based

on weighted average fair value at date of Merger ..................... $— $32 $—

Aggregate fair value of shares granted based on weighted average fair value at

date of grant .................................................. 31 11 6

Aggregate fair value of shares vesting during period ..................... 20 18 1

Aggregate fair value of shares forfeited during period .................... 7 13 —

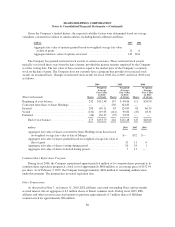

Common Share Repurchase Program

During fiscal 2006, the Company repurchased approximately 6 million of its common shares pursuant to its

common share repurchase program at a total cost of approximately $806 million, or an average price of $132.94

per share. As of February 3, 2007, the Company had approximately $604 million of remaining authorization

under this program. The program has no stated expiration date.

Other Transactions

As discussed in Note 7, on January 31, 2005, ESL affiliates converted outstanding Notes and six month

accrued interest into an aggregate of 6.3 million shares of Kmart common stock. During fiscal 2005, ESL

affiliates and other investors exercised options to purchase approximately 6.7 million shares of Holdings

common stock for approximately $86 million.

86