Sears 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

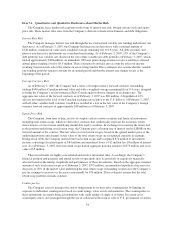

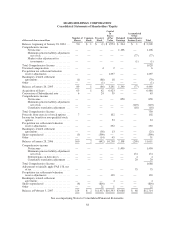

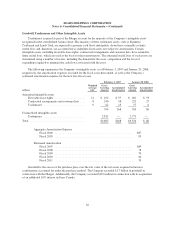

SEARS HOLDINGS CORPORATION

Consolidated Statements of Shareholders’ Equity

dollars and shares in millions

Number of

Shares

Common

Stock

Treasury

Stock

Capital

in

Excess

of Par

Value

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss) Total

Balance, beginning of January 28, 2004 . . . 90 $ 1 $ (1) $ 1,974 $ 234 $ 1 $ 2,209

Comprehensive income

Netincome...................... — — — — 1,106 — 1,106

Minimum pension liability adjustment,

netoftax ..................... — — — — — (77) (77)

Market value adjustment for

investments ................... — — — — — (1) (1)

TotalComprehensiveIncome ........... 1,028

Unearned compensation ............... — — 4 2 — — 6

Pre-petition tax settlement/valuation

reserve adjustments ................. — — — 1,297 — — 1,297

Bankruptcy related settlement

agreements ........................ (1) — (88) 18 — — (70)

Other .............................. — — (1) — — — (1)

Balance at January 26, 2005 ............ 89 1 (86) 3,291 1,340 (77) 4,469

Acquisition of Sears .................. 63 1 62 6,423 — — 6,486

Conversion of Subordinated note ........ 6 — 24 39 — — 63

Comprehensive income

Netincome...................... — — — — 858 — 858

Minimum pension liability adjustment,

netoftax ..................... — — — — — (110) (110)

Cumulative translation adjustment . . . — — — — — (18) (18)

TotalComprehensiveIncome ........... 730

Proceeds from exercise of stock options . . . 7 — — 102 — — 102

Income tax benefit on non-qualified stock

options ........................... — — — 53 — — 53

Pre-petition tax settlements/valuation

reserve adjustments ................. — — — 292 — — 292

Bankruptcy related settlement

agreements ........................ — — (38) 13 — — (25)

Shares repurchased ................... (5) — (590) — — — (590)

Other .............................. — — (14) 45 — — 31

Balance at January 28, 2006 ............ 160 2 (642) 10,258 2,198 (205) 11,611

Comprehensive income

Netincome...................... — — — — 1,490 — 1,490

Minimum pension liability adjustment,

netoftax ..................... — — — — — 174 174

Deferred gain on derivatives ........ — — — — — 4 4

Cumulative translation adjustment . . . — — — — — 20 20

TotalComprehensiveIncome ........... 1,688

Adjustment to initially apply FAS 158, net

oftax ............................ — — — — — 75 75

Pre-petition tax settlements/valuation

reserve adjustments ................. — — — 130 — — 130

Bankruptcy related settlement

agreements ........................ — — — 4 — — 4

Shares repurchased ................... (6) — (816) — — — (816)

Other .............................. — — 21 1 — — 22

Balance at February 3, 2007 ............ 154 $ 2 $(1,437) $10,393 $3,688 $ 68 $12,714

See accompanying Notes to Consolidated Financial Statements.

58