Sears 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

Unrecognized net gains in accumulated other comprehensive income are not expected to be amortized as a

component of net periodic benefit cost during fiscal 2007.

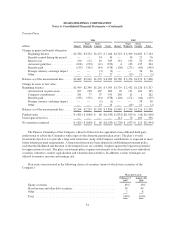

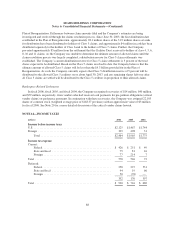

Information regarding expected future cash flows for the Company’s benefit plans is as follows:

millions Kmart

Sears

Domestic

Sears

Canada Total

Pension benefits:

Employer contributions:

Fiscal 2007 (expected) ................................... $ 47 $ 146 $— $ 193

Expected benefit payments:

Fiscal 2007 ................................................ $145 $ 220 $ 67 $ 432

Fiscal 2008 ................................................ 148 205 68 421

Fiscal 2009 ................................................ 153 195 69 417

Fiscal 2010 ................................................ 157 199 70 426

Fiscal 2011 ................................................ 162 204 71 437

Fiscal 2012-2016 ........................................... 893 1,050 379 2,322

Postretirement benefits:

Employer contributions:

Fiscal 2007 (expected) ................................... $— $ 43 $ 15 $ 58

Expected benefit payments:

Fiscal 2007 ................................................ $— $ 43 $ 15 $ 58

Fiscal 2008 ................................................ — 42 16 58

Fiscal 2009 ................................................ — 40 17 57

Fiscal 2010 ................................................ — 38 18 56

Fiscal 2011 ................................................ — 36 18 54

Fiscal 2012-2016 ........................................... — 153 96 249

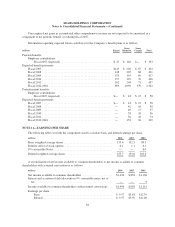

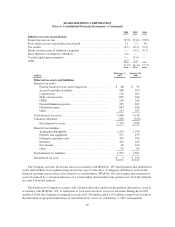

NOTE 11—EARNINGS PER SHARE

The following tables set forth the components used to calculate basic and diluted earnings per share.

millions 2006 2005 2004

Basic weighted average shares .................................. 155.6 152.5 89.3

Dilutive effect of stock options ................................. 0.1 1.1 6.1

9% convertible Notes ......................................... — — 6.0

Diluted weighted average shares ................................ 155.7 153.6 101.4

A reconciliation of net income available to common shareholders to net income available to common

shareholders with assumed conversions is as follows:

millions 2006 2005 2004

Net income available to common shareholders ..................... $1,490 $ 858 $1,106

Interest and accretion of debt discount on 9% convertible notes, net of

tax ...................................................... — — 9

Income available to common shareholders with assumed conversions . . . $1,490 $ 858 $1,115

Earnings per share

Basic .................................................. $ 9.57 $5.63 $12.39

Diluted ................................................ $ 9.57 $5.59 $11.00

84