Sears 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to the sale of the Company’s Trinidad subsidiary and its associated property, $12 million related to the sale of

corporate airplanes and $42 million from sales of other real and personal property.

Restructuring charges were $111 million (reported and pro forma) for fiscal 2005 as compared to $0 million

(reported) and $41 million (pro forma) for fiscal 2004. The fiscal 2005 charges included a $57 million charge for

employee-related termination costs associated with the above-noted Sears Canada restructuring initiatives

implemented during fiscal 2005, as well as $54 million at Kmart for relocation assistance and employee

termination-related costs associated with Holdings’ home office integration efforts. The $41 million charge

recorded in fiscal 2004 reflected a charge recorded by Sears in fiscal 2004 as part of a productivity initiative at

that entity.

Fiscal 2005 included a $317 million gain on sale of business, which reflected a minority interest gain on the

sale of Sears Canada’s Credit and Financial Services operations in November 2005 as discussed above.

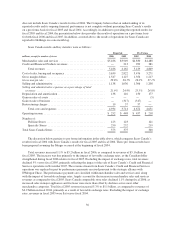

Interest and investment income was $127 million (reported) and $159 million (pro forma) in fiscal 2005, as

compared to $41 million (reported) and $153 million (pro forma) for fiscal 2004. The increase in reported

interest and investment income was primarily attributable to the addition of Sears, which accounted for $62

million of the combined interest and investment income in fiscal 2005.

Interest expense was $323 million (reported) and $378 million (pro forma) in fiscal 2005, as compared to

$146 million (reported) and $442 million (pro forma) for fiscal 2004. The increase in reported interest expense

was a result of the inclusion of Sears debt in fiscal 2005, which accounted for $195 million of the combined

interest expense in fiscal 2005, as well as additional interest expense incurred upon the conversion of Kmart’s

9% subordinated convertible notes, as further described in the “Uses and Sources of Liquidity” section below.

The decline in pro forma interest expense was due primarily to lower average borrowings.

Other income is primarily comprised of bankruptcy-related recoveries. Bankruptcy-related recoveries

decreased $19 million in fiscal 2005 and represented amounts recognized from vendors who had received cash

payment for pre-petition obligations. See Note 13 of Notes to Consolidated Financial Statements for further

detail.

The reported effective tax rate decreased to 36.4% in fiscal 2005 from 37.7% in fiscal 2004, with the

decrease primarily attributable to the November 2005 sale of Sears Canada’s Credit and Financial Service

business being taxed at a capital gains rate, lowering the effective tax rate for fiscal 2005. The pro forma

effective tax rate increased to 37.3% in fiscal 2005 from 34.6% in fiscal 2004, with the lower fiscal 2004

effective rate attributable to the inclusion of Sears.

As noted above, effective January 27, 2005, the Company changed its method of accounting for certain

indirect overhead costs from inventoriable costs to period expenses and as a result recorded a charge of

$90 million, net of taxes, in the first quarter of fiscal 2005 for the cumulative effect of this change in accounting

principle. See Note 3 of Notes to Consolidated Financial Statements for further detail.

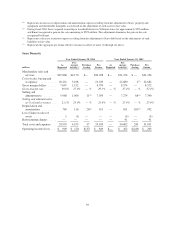

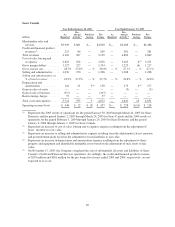

Business Segment Results

Holdings has integrated many Kmart and Sears store-support functions to more efficiently serve both

formats; however, for purposes of reviewing operating performance and making asset-allocation decisions, senior

management has continued to utilize principally the reporting structures that existed independently for Sears and

Kmart prior to the Merger. As a result, the following discussion of the Company’s business segments is

organized into three segments: Kmart, Sears Domestic and Sears Canada.

31