Sears 2006 Annual Report Download - page 26

Download and view the complete annual report

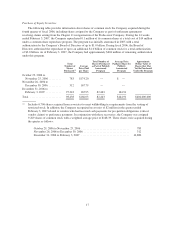

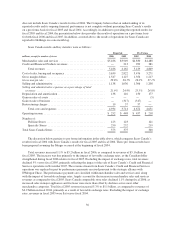

Please find page 26 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Sears. The pro forma gain on sale of assets impact for fiscal 2004, $1.35 per diluted share as shown above,

excludes the impact of gains recognized in fiscal 2004 for sales of properties to Sears. Further details pertaining

to these transactions are set forth in Note 15 of Notes to Consolidated Financial Statements.

Additionally, all three fiscal years were impacted by restructuring charges. These pre-tax charges were $28

million ($14 million after-tax or $0.09 per diluted share) in fiscal 2006, $111 million ($54 million after-tax or

$0.35 per diluted share- reported, $53 million after-tax or $0.33 per diluted share- pro forma) in fiscal 2005, and

pro forma $41 million (pro forma $26 million after-tax or $0.16 per diluted share- pro forma) in fiscal 2004. The

charges for both fiscal 2006 and fiscal 2005 were recorded in connection with the Merger and integration of

Sears’ and Kmart’s headquarters support functions, as well as in connection with productivity initiatives at Sears

Canada. The fiscal 2004 pro forma restructuring charges were recorded by Sears in connection with certain

productivity initiatives at that entity. Further details pertaining to these restructuring charges are set forth in

Note 6 of Notes to Consolidated Financial Statements.

Fiscal 2005 net income was negatively impacted by an after-tax charge of $90 million ($0.58 per diluted

share- reported, $0.55 per diluted share- pro forma) for the cumulative effect of a change in accounting for

certain indirect overhead costs included in inventory. Further details pertaining to this cumulative effect charge

are set forth in Note 3 of Notes to Condensed Consolidated Financial Statements.

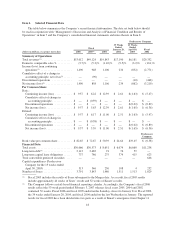

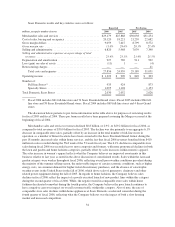

Total Revenues and Comparable Store Sales

Fiscal 2006 domestic comparable store sales were down 3.7% in the aggregate, with Sears Domestic

declining 6.1% and Kmart declining 0.6%. These declines are less than fiscal 2005 domestic comparable store

sales declines of 5.3% in the aggregate, and declines of 8.4% and 1.2% at Sears Domestic and Kmart,

respectively. As was the case in fiscal 2005, the current year declines primarily reflect the impact of increased

competition and lower transaction volumes across most merchandise categories and formats. In fiscal 2006,

notably larger declines within Sears Domestic’s lawn and garden and home fashions businesses (as further

discussed below in the review of Sears Domestic’s results), were partially offset by increased apparel and

pharmacy sales at Kmart, and increased women’s apparel sales at Sears Domestic. The fiscal 2006 sales increase

within women’s apparel at Sears Domestic was driven by stronger performance during the second half of the

year, reflecting what the Company believes are improved assortments in this category relative to last year. In

fiscal 2005, Sears Domestic modified its apparel assortment to a more “fashion forward” offering, which was not

successful and led to significant sales declines within Sears Domestic’s apparel business during the second half

of 2005.

For the fourth quarter of fiscal 2006, which includes the holiday selling season, domestic comparable store

sales declined 3.1% in the aggregate, with Sears Domestic and Kmart recording comparable store sales declines

of 4.9% and 0.9%, respectively. Fourth quarter comparable sales results largely reflect the same factors as noted

above; however, during the fourth quarter of fiscal 2006, the Company experienced a sales decline in its home

appliances business as a result of the slower U.S. housing market and increased competition.

While the Company believes that its efforts will make its products, brands and service offerings more

responsive to the needs of customers and thereby improve the trend in domestic comparable store sales results

during fiscal 2007, the benefits derived from such efforts may be mitigated by the impact of continued market

share pressure as competitors open additional locations and engage in heavy promotional activity. The Company

expects these competitive trends to continue in the foreseeable future which may negatively affect both the

Company’s sales performance and results of operations.

Total revenues for fiscal 2006 were $53.0 billion, as compared to revenues of $49.1 billion (reported) and

$54.3 billion (pro forma) for fiscal 2005. The increase in fiscal 2006 revenues as compared to reported revenues

in fiscal 2005 was primarily due to the inclusion of Sears for the entire year in fiscal 2006 and, to a lesser degree,

the inclusion of an additional week of sales in fiscal 2006 (comprised of 53 weeks) as compared to fiscal 2005

26