Sears 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

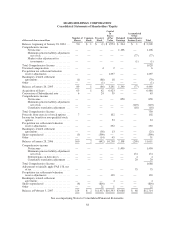

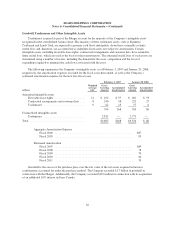

SEARS HOLDINGS CORPORATION

Consolidated Statements of Cash Flows

millions 2006 2005 2004

CASH FLOWS FROM OPERATING ACTIVITIES

Net income ........................................................... $1,490 $ 858 $1,106

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ........................................ 1,142 932 27

Cumulative effect of change in accounting principle, net of tax .............. — 90 —

Provision for uncollectible credit card accounts ........................... — 49 —

Gain on total return swaps, net ........................................ (74) — —

Gain on sales of assets ............................................... (82) (39) (946)

Gain on sale of investments .......................................... (18) (38) —

Change in operating assets and liabilities (net of acquisitions and

dispositions): ....................................................

Deferred income taxes ........................................... 258 58 597

Credit card receivables .......................................... — (380) —

Merchandise inventories ......................................... (841) 208 (43)

Merchandise payables ........................................... (145) (71) 251

Income and other taxes .......................................... (173) (53) 66

Other operating assets ........................................... 193 318 100

Other operating liabilities ........................................ (306) 366 (90)

Net cash provided by operating activities ................................ 1,444 2,298 1,068

CASH FLOWS FROM INVESTING ACTIVITIES

Acquisitions of businesses, net of cash acquired .......................... (283) (1,020) —

Proceeds from sale of business ........................................ — 2,044 —

Proceeds from sales of property and investments .......................... 143 157 562

Purchases of property and equipment ................................... (513) (546) (230)

Change in collateral on total return swaps, net ............................ (80) — —

Cash settlements on total return swaps, net ............................... 70 — —

Net cash (used in) provided by investing activities ......................... (663) 635 332

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from debt issuances ......................................... 524 176 —

Repayments of long-term debt ........................................ (875) (577) (53)

Decrease in short-term borrowings, primarily 90 days or less ................ (83) (414) —

Proceeds from termination of interest rate swaps .......................... — 60 —

Sears Canada dividend paid to minority shareholders ...................... — (794) —

Issuance of subsidiary stock .......................................... — 59 —

Purchase of treasury stock ............................................ (816) (590) —

Debt issue costs .................................................... (2) (27) —

Income tax benefit on exercise of nonqualified stock options ................ — 53 —

Proceeds from the exercise of stock options .............................. — 102 —

Net cash used in financing activities .................................... (1,252) (1,952) (53)

Effect of exchange rate changes on cash and cash equivalents .................... (1) 24 —

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS ......... (472) 1,005 1,347

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR ............... 4,440 3,435 2,088

CASH AND CASH EQUIVALENTS, END OF YEAR ...................... $3,968 $ 4,440 $3,435

SUPPLEMENTAL DISCLOSURE ABOUT NON-CASH INVESTING AND

FINANCING ACTIVITIES:

Bankruptcy related settlements resulting in the receipt of treasury stock ............ $ 3 $ 25 $ 88

Sale of owned and assignment of leased properties ............................ — — 403

Conversion of 9% convertible note ......................................... — 63 —

Capital lease obligation incurred ........................................... 61 65 49

Supplemental Cash Flow Data:

Income taxes paid .................................................. 574 114 6

Cash interest paid .................................................. 282 255 52

See accompanying Notes to Consolidated Financial Statements.

57