Sears 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

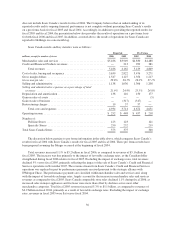

does not include Sears Canada’s results for fiscal 2004. The Company believes that an understanding of its

reported results and its ongoing financial performance is not complete without presenting Sears Canada’s results

on a pro forma basis for fiscal 2005 and fiscal 2004. Accordingly, in addition to providing the reported results for

fiscal 2005 and fiscal 2004, the presentation below also provides the results of operations on a pro forma basis

for both fiscal 2006 and fiscal 2005. In addition, as noted above, the results of operations for Sears Canada are

reported to Holdings on a one-month lag.

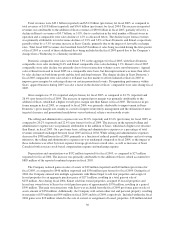

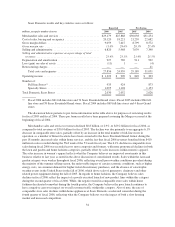

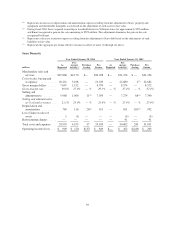

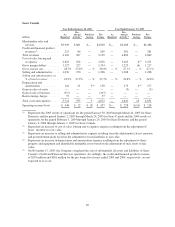

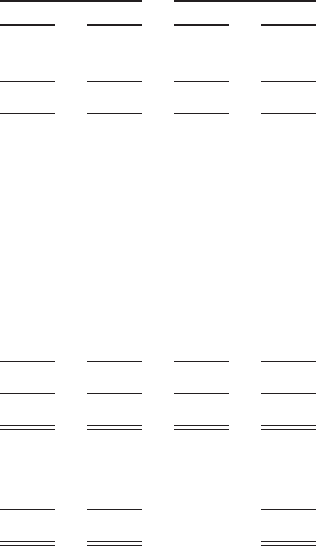

Sears Canada results and key statistics were as follows:

Reported Pro Forma

millions, except for number of stores 2006 2005 2005 2004

Merchandise sales and services ................................ $5,186 $3,949 $4,830 $4,488

Credit and Financial Products revenues .......................... — 213 299 381

Total revenues ......................................... 5,186 4,162 5,129 4,869

Cost of sales, buying and occupancy ............................ 3,639 2,822 3,476 3,271

Gross margin dollars ........................................ 1,547 1,127 1,354 1,217

Gross margin rate .......................................... 29.8% 28.5% 28.0% 27.1%

Selling and administrative .................................... 1,138 1,036 1,306 1,208

Selling and administrative expenses as a percentage of total

revenues ................................................ 21.9% 24.9% 25.5% 24.8%

Depreciation and amortization ................................. 138 116 150 177

Gain on sales of assets ....................................... — — — (5)

Gain on sale of business ...................................... — (317) (317) —

Restructuring charges ........................................ 19 57 57 —

Total costs and expenses ................................. 4,934 3,714 4,672 4,651

Operating income ........................................... $ 252 $ 448 $ 457 $ 218

Number of:

Full-line Stores ......................................... 123 123 121

Specialty Stores ........................................ 250 252 219

Total Sears Canada Stores .................................... 373 375 340

The discussion below pertains to pro forma information in the table above, which compares Sears Canada’s

results for fiscal 2006 with Sears Canada’s results for fiscal 2005 and fiscal 2004. These pro forma results have

been prepared assuming the Merger occurred at the beginning of fiscal 2004.

Total revenues increased 1.1% to $5.2 billion in fiscal 2006, as compared to revenues of $5.1 billion in

fiscal 2005. The increase was due primarily to the impact of favorable exchange rates, as the Canadian dollar

strengthened during fiscal 2006 relative to fiscal 2005. Excluding the impact of exchange rates, total revenues

declined 5% versus fiscal 2005, primarily reflecting the impact of the sale of Sears Canada’s Credit and Financial

Services operations in November 2005. The revenue stream from Sears Canada’s Credit and Financial Services

operations was replaced in part by performance payments received pursuant to the strategic alliance with

JPMorgan Chase. The performance payments are classified within merchandise sales and services and, along

with the impact of favorable exchange rates, largely account for the increase in merchandise sales and services

revenues as compared to fiscal 2005. Sears Canada comparable store sales declined 1.1% during fiscal 2006, as

increased sales in major appliances and footwear were more than offset by declines across most other

merchandise categories. Total fiscal 2005 revenues increased 5.3% to $5.1 billion, as compared to revenues of

$4.9 billion in fiscal 2004, primarily as a result of favorable exchange rates. Excluding the impact of exchange

rates, revenues in fiscal 2005 were flat versus fiscal 2004.

36