Sears 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

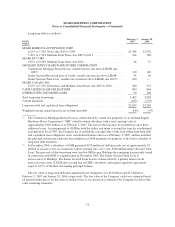

between the financial and tax bases of assets and liabilities based on currently enacted tax laws. The tax balances

and income tax expense recognized by the Company are based on management’s interpretation of the tax laws of

multiple jurisdictions. Income tax expense also reflects the Company’s best estimates and assumptions regarding,

among other things, the level of future taxable income, interpretation of the tax laws, and tax planning. Future

changes in tax laws, changes in projected levels of taxable income, tax planning, and the adoption/

implementation of FIN 48 in fiscal 2007 (discussed below), could affect the effective tax rate and tax balances

recorded by the Company.

Stock-based Compensation

The Company accounts for stock-based compensation arrangements in accordance with SFAS No. 123(R),

“Share-Based Payments.” SFAS 123 (R) requires the Company to recognize as expense the fair value of all

stock-based compensation awards including stock options, an accounting method that the Company adopted

voluntarily in fiscal 2003, and classification of excess tax benefits associated with share-based compensation

deductions as cash from financing activities rather than cash from operating activities. The Company recognizes

compensation expense as awards vest on a straight-line basis over the requisite service period of the award.

Earnings Per Common Share

Basic earnings per common share is calculated by dividing net income available to common shareholders by

the weighted average number of common shares outstanding for each period. Diluted earnings per common share

also includes the dilutive effect of potential common shares: exercise of stock options, the conversion of

convertible debt and the effect of restricted stock when dilutive.

New Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”) ratified the consensus reached on

Emerging Issues Task Force (“EITF”) Issue No. 06-03, “How Sales Taxes Collected from Customers and

Remitted to Governmental Authorities Should Be Presented in the Income Statement (That is, Gross Versus Net

Presentation).” The EITF reached a consensus that the presentation of taxes on either a gross or a net basis is an

accounting policy decision that requires disclosure. EITF 06-3 is effective for the first interim or annual reporting

period beginning after December 15, 2006. The adoption of EITF 06-3 will not have any effect on the

Company’s financial position or results of operations. The Company’s revenues are reported net of sales taxes.

In July 2006, the FASB issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes–

an Interpretation of FASB Statement No. 109” (“FIN 48”). This Interpretation prescribes a recognition threshold

and measurement process for recording within the financial statements uncertain tax positions taken or expected

to be taken in a tax return. In addition, FIN 48 provides guidance on derecognition, classification, interest,

penalties, accounting in interim periods and disclosure related to uncertain tax positions. The provisions of FIN

48 are effective as of the beginning of the Company’s 2007 fiscal year. The Company is currently evaluating the

impact of the adoption of FIN 48, during the first quarter of 2007, on its financial statements and operating

results. The Company currently estimates that the adoption of FIN 48 will not have any material impact on the

Company’s financial position or results of operations. The Company’s evaluation of the impact of FIN 48 is

continuing, however, and is subject to revision when the Company completes its analysis.

In September 2006, the SEC issued Staff Accounting Bulletin (“SAB”) No. 108, “Considering the Effects of

Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements,” which

provides interpretive guidance on the consideration of the effects of prior year misstatements in quantifying

current year misstatements for the purpose of a materiality assessment. SAB No. 108 is effective for annual

66