Sears 2006 Annual Report Download - page 51

Download and view the complete annual report

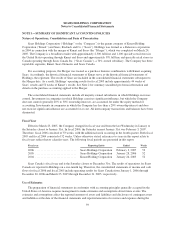

Please find page 51 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In September 2006, the FASB issued SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans.” See Note 3 of Notes to Consolidated Financial Statements for further

information regarding the impact of adopting this standard.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and

Financial Liabilities.” SFAS No. 159 expands the scope of specific types of assets and liabilities that an entity

may carry at fair value on its statement of financial position, and offers an irrevocable option to record the vast

majority of financial assets and liabilities at fair value, with changes in fair value recorded in earnings. SFAS

No. 159 is effective for fiscal years beginning after November 15, 2007. The Company is currently evaluating the

impact, if any, SFAS No. 159 will have on its financial statements.

Cautionary Statement Regarding Forward-Looking Information

Certain statements made in this Annual Report on Form 10-K and in other public announcements by the

Company contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are subject to risks and uncertainties that may cause the Company’s actual

results, performance or achievements to be materially different from any future results, performance or

achievements expressed or implied by these forward-looking statements. Forward-looking statements include

information concerning the Company’s future financial performance, business strategy, plans, goals and

objectives. Statements preceded or followed by, or that otherwise include, the words “believes”, “expects”,

“anticipates”, “intends”, “estimates”, “plans”, “forecasts”, “is likely to”, “projected” and similar expressions or

future or conditional verbs such as “will”, “should”, “would”, “may” and “could” are generally forward-looking

in nature and not historical facts. Such statements include, but are not limited to, statements about the expected

performance of various business initiatives and future financial and operating results. Such statements are based

upon the current beliefs and expectations of Holdings’ management and are subject to significant risks and

uncertainties. Actual results may differ materially from those set forth in the forward-looking statements.

The following factors, among others, could cause actual results to differ from those set forth in the

forward-looking statements:

• the ability to attract, motivate and retain key executives and other associates;

• competitive conditions in the retail and related services industries;

• changes in consumer confidence, tastes, preferences and spending, including the impact of fuel costs on

spending patterns, and the availability and level of consumer debt;

• marketplace demand for the Company’s proprietary brand products and the products of the Company’s

key brand licensors;

• operational or financial difficulties at any of the Company’s key vendors;

• the successful execution of, and customer response to, strategic initiatives, including the full-line store

and off-mall strategies, and the cross–merchandising of products and services, including Craftsman and

Kenmore brand products, between the Kmart and Sears formats;

• the impact of seasonal buying patterns, including seasonal fluctuations due to weather conditions,

which are difficult to forecast with certainty;

• the Company’s ability to successfully invest available capital;

• the pace of growth in store locations, which may be higher or lower than anticipated;

• the ability to successfully implement initiatives to improve inventory management and other

capabilities;

• the possibility that new business and strategic options for one or more business segments will be

identified, potentially including selective acquisitions, dispositions, restructurings, joint ventures and

partnerships;

51