Sears 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.bankruptcy in fiscal 2003. As further discussed in Note 13 of Notes to Consolidated Financial Statements,

due to the application of Fresh-Start Accounting (defined in Note 13 of Notes to Consolidated Financial

Statements) upon emergence from Chapter 11 bankruptcy, the reported historical financial statements of the

Predecessor Company for the periods prior to May 1, 2003 generally are not comparable to those of the

Successor Company. Thus, the results of operations of the Successor Company were not combined with

those of the Predecessor Company.

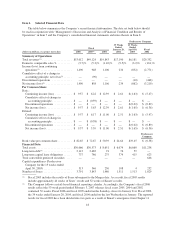

(3) The periods presented were impacted by certain significant items which affected the comparability of

amounts reflected in the above selected financial data. For fiscal 2006, 2005 and 2004, these significant

items are discussed within Item 7, “Management’s Discussion and Analysis of Financial Condition and

Results of Operations.” In addition, the 39 weeks ended January 28, 2004, included an $89 million net gain

on sales of assets; the 13 weeks ended April 30, 2003, included $769 million in expenses incurred by the

Predecessor Company as a result of its Chapter 11 reorganization, a $47 million charge for accelerated

depreciation on unimpaired assets to be disposed of following store closings, and a $10 million credit as a

result of a change in the estimated expenses for 2002 cost reduction initiatives; Fiscal 2002, included

$1,019 million for inventory write-downs in conjunction with accelerated mark-downs due to store closings,

$533 million for asset impairments, $50 million for cost reduction initiatives, and $33 million for other

items.

(4) For fiscal year 2002, long-term debt does not include liabilities classified as subject to compromise.

19