Sears 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Sears annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEARS HOLDINGS CORPORATION

Notes to Consolidated Financial Statements—(Continued)

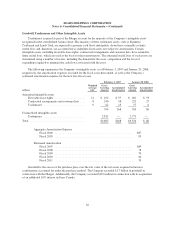

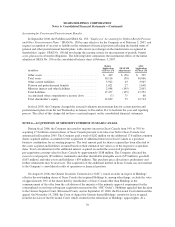

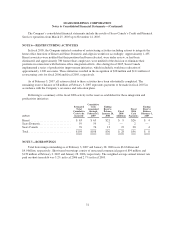

Goodwill, Tradenames and Other Intangible Assets

Tradenames acquired as part of the Merger account for the majority of the Company’s intangible assets

recognized in the consolidated balance sheet. The majority of these tradename assets, such as Kenmore,

Craftsman and Lands’ End, are expected to generate cash flows indefinitely, do not have estimable or finite

useful lives and, therefore, are accounted for as indefinite-lived assets not subject to amortization. Certain

intangible assets, including favorable lease rights, contractual arrangements and customer lists, have estimable,

finite useful lives, which are used as the basis for their amortization. The estimated useful lives of such assets are

determined using a number of factors, including the demand for the asset, competition and the level of

expenditure required to maintain the cash flows associated with the asset.

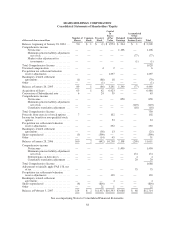

The following summarizes the Company’s intangible assets as of February 3, 2007 and January 28, 2006,

respectively, the amortization expenses recorded for the fiscal years then ended, as well as the Company’s

estimated amortization expense for the next five fiscal years.

February 3, 2007 January 28, 2006

millions

Weighted

Average

Life

Gross

Carrying

Amount

Accumulated

Amortization

Gross

Carrying

Amount

Accumulated

Amortization

Amortized intangible assets

Favorable lease rights ...................... 21 $ 492 $ 97 $ 481 $ 53

Contractual arrangements and customer lists .... 8 240 58 225 27

Tradenames ............................. 9 62 13 57 6

794 168 763 86

Unamortized intangible assets

Tradenames ............................. 2,811 — 2,771 —

Total ....................................... $3,605 $168 $3,534 $ 86

Aggregate Amortization Expense

Fiscal 2006 ....................................................... $87

Fiscal 2005 ....................................................... 99

Estimated Amortization

Fiscal 2007 ....................................................... $89

Fiscal 2008 ....................................................... 78

Fiscal 2009 ....................................................... 70

Fiscal 2010 ....................................................... 64

Fiscal 2011 ....................................................... 59

Goodwill is the excess of the purchase price over the fair value of the net assets acquired in business

combinations accounted for under the purchase method. The Company recorded $1.7 billion in goodwill in

connection with the Merger. Additionally, the Company recorded $167 million in connection with its acquisition

of an additional 16% interest in Sears Canada.

62