Rosetta Stone 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

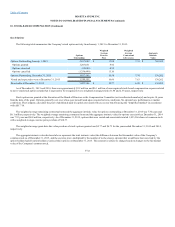

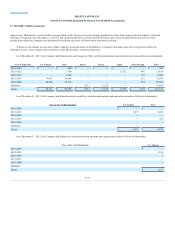

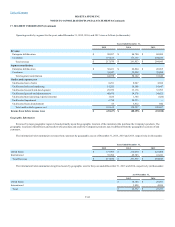

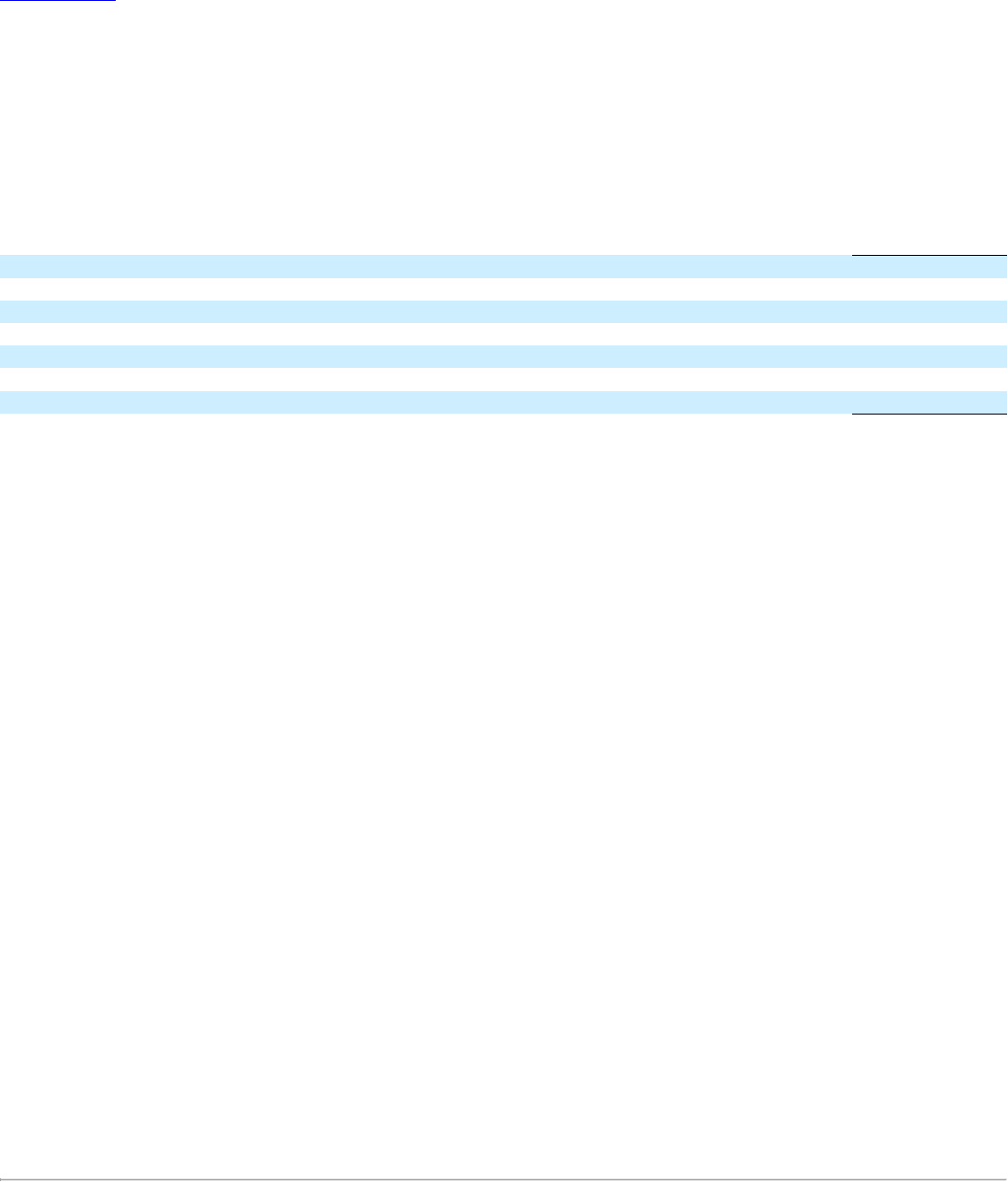

The following table summarizes future minimum operating lease payments as of December 31, 2015 and the years thereafter (in thousands):

Periods Ending December 31,

2016

$ 5,591

2017

4,367

2018

3,829

2019

1,253

2020

962

Thereafter

590

Total future minimum operating lease payments

$ 16,592

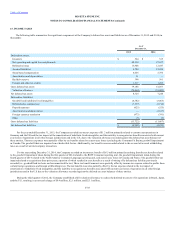

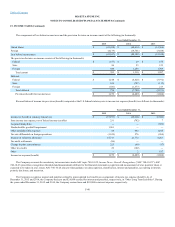

Total expenses under operating leases were $5.1 million, $5.6 million and $7.1 million during the years ended December 31, 2015, 2014 and 2013,

respectively.

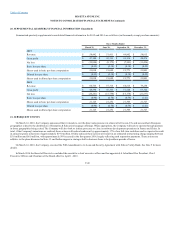

The Company accounts for its leases under the provisions of ASC topic 840, ("ASC 840"), which require that leases be evaluated

and classified as operating leases or capital leases for financial reporting purposes. Certain operating leases contain rent escalation clauses, which are

recorded on a straight-line basis over the initial term of the lease with the difference between the rent paid and the straight-line rent recorded as either a

deferred rent asset or liability depending on the calculation. Lease incentives received from landlords are recorded as deferred rent liabilities and are

amortized on a straight-line basis over the lease term as a reduction to rent expense.

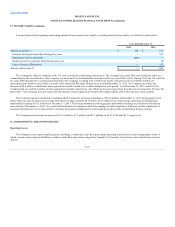

Royalty Agreements

The Company has entered into agreements to license software from vendors for incorporation in the Company's products. Pursuant to some of these

agreements, the Company is required to pay minimum royalties or license fees over the term of the agreement regardless of actual license sales. In addition,

such agreements typically specify that, in the event the software is incorporated into specified Company products, royalties will be due at a contractual rate

based on actual sales volumes. These agreements are subject to various royalty rates typically calculated based on the level of sales for those products. The

Company expenses these amounts to cost of sales or research and development expense, as appropriate. Royalty expense was $0.2 million, $31,000, and $0

for the years ended December 31 2015, 2014 and 2013, respectively.

Employment Agreements

The Company has agreements with certain of its executives and key employees which provide guaranteed severance payments upon termination of

their employment without cause.

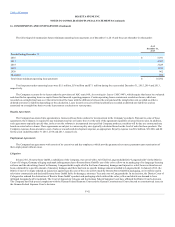

Litigation

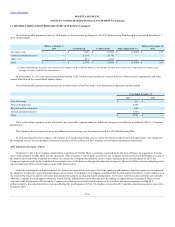

In June 2011, Rosetta Stone GmbH, a subsidiary of the Company, was served with a writ filed by Langenscheidt KG (“Langenscheidt”) in the District

Court of Cologne, Germany alleging trademark infringement due to Rosetta Stone GmbH’s use of the color yellow on its packaging of its language-learning

software and the advertising thereof in Germany. Langenscheidt sought relief in the form of monetary damages and injunctive relief; however there has not

been a demand for a specific amount of monetary damages and there has been no specific damage amount awarded to Langenscheidt. In January 2012, the

District Court of Cologne ordered an injunction against specific uses of the color yellow made by Rosetta Stone GmbH in packaging, on its website and in

television commercials and declared Rosetta Stone GmbH liable for damages, attorneys’ fees and costs to Langenscheidt. In its decision, the District Court of

Cologne also ordered the destruction of Rosetta Stone GmbH’s product and packaging which utilized the color yellow and which was deemed to have

infringed Langenscheidt’s trademark. The Court of Appeals in Cologne and the German Federal Supreme Court have affirmed the District Court's decision.

The Company has filed special complaints with the German Federal Supreme Court and the German Constitutional Court directed to constitutional issues in

the German Federal Supreme Court’s decision.

F-42