Rosetta Stone 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

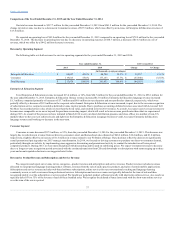

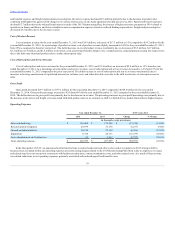

General and Administrative Expenses

General and administrative expenses for the year ended December 31, 2014 were $57.1 million, an increase of $0.7 million, or 1%, from the year ended

December 31, 2013. As a percentage of revenue, general and administrative expenses increased to 22% for the year ended December 31, 2014 compared to

21% for year ended December 31, 2013. The dollar and percentage increases were primarily attributable to a $1.3 million increase in building expenses

related to a Japan office lease termination and higher dues and subscription fees incurred by the human resources and finance groups. The dollar increase was

also attributable to a $1.0 million increase in bad debt expense driven from increased accounts receivable aging and additional reserves related to acquired

receivables. In addition, general and administrative expense increased $0.5 million due to increased acquisition related software and systems maintenance

and integration work performed during the year ended December 31, 2014. These increases were partially offset by a $1.3 million decrease in payroll due to a

decrease in long-term incentive plan expense and bonus expense as well as a decrease in restricted stock and stock option expenses as a result of the decrease

in our stock price during the year ended December 31, 2014. Rent expense also decreased by $0.6 million due to the lease abandonment of the Arlington,

Virginia sixth floor lease during early 2014.

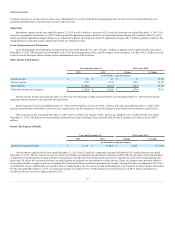

Impairment

Impairment expense for the year ended December 31, 2014 was $20.3 million, an increase of $20.3 million, from the year ended December 31, 2013.

The increase was primarily attributable to a $20.2 million goodwill impairment charge related to our Consumer Language reporting units taken in 2014. The

goodwill impairment charges were primarily a result of the decline in demand for Consumer language-learning products and services at their current pricing

levels and a change in international go-to-market strategy. In an effort to compensate for the consumer preferences, we lowered our prices and used retail

partnerships to increase sales. Despite these actions, the results were significantly lower than the forecasted sales. As a result of the above events, we

performed an impairment analysis and determined that the Consumer Language reporting units were fully impaired and recorded goodwill impairment

charges totaling $20.2 million. The additional $0.2 million of expense related to the abandonment of a previously capitalized internal-use software project.

Lease Abandonment and Termination

Lease abandonment and termination expenses for the year ended December 31, 2014 were $3.8 million, compared to $0.8 million for the year ended

December 31, 2013. The increase was primarily attributable to the lease abandonment of the sixth floor space in the Arlington, VA office of $3.2 million, as

well as the closure of the Japan office resulting in lease abandonment costs of $0.4 million.

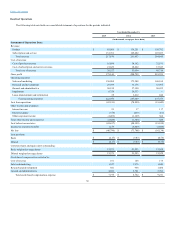

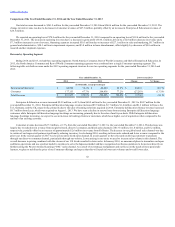

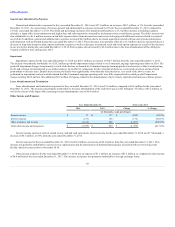

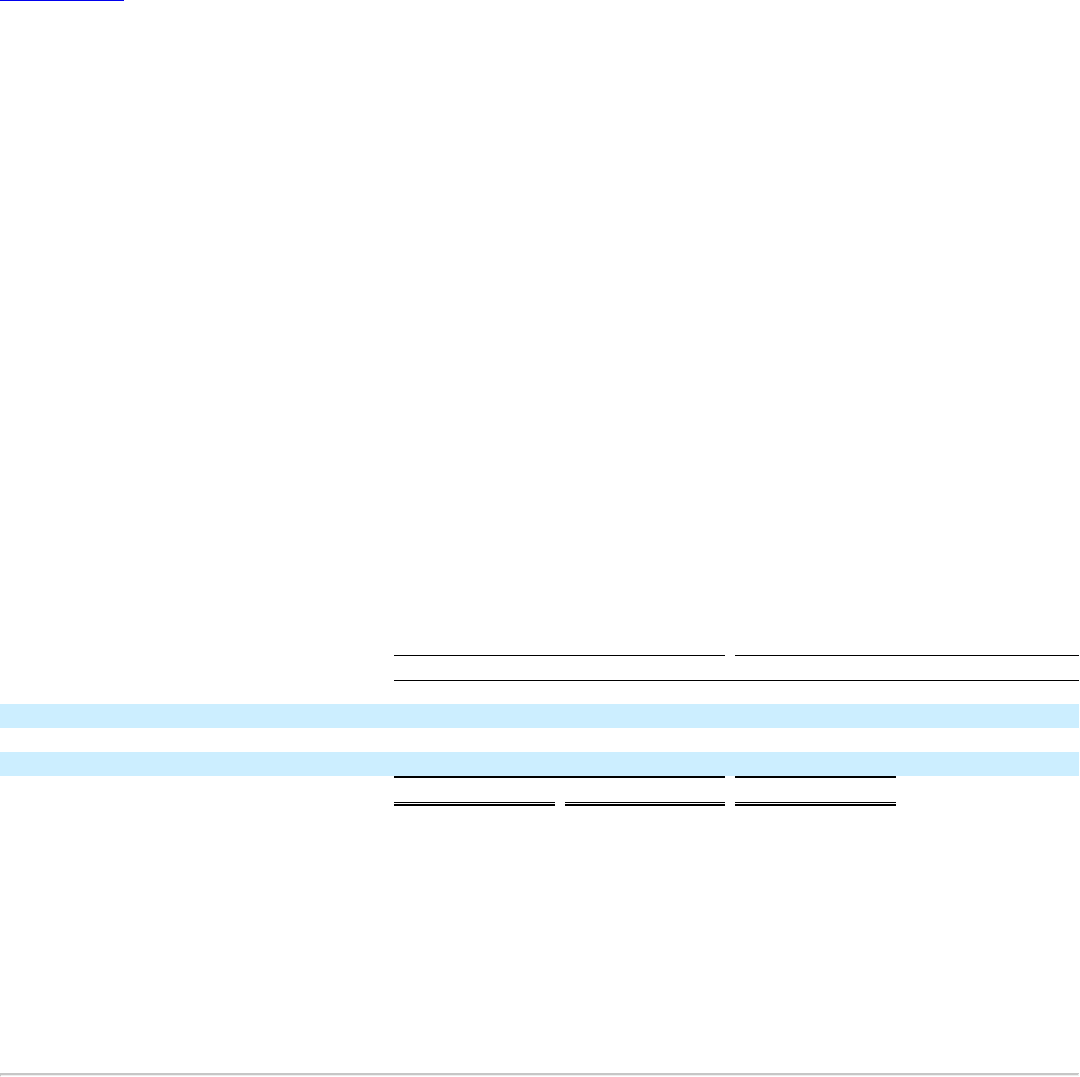

Interest income

$ 17

$ 117

$ (100)

(85.5)%

Interest expense

(233)

(61)

(172)

282.0 %

Other (expense) and income

(1,129)

368

(1,497)

(406.8)%

Total other income and (expense)

$ (1,345)

$ 424

$ (1,769)

(417.2)%

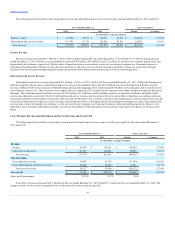

Interest income represents interest earned on our cash and cash equivalents. Interest income for the year ended December 31, 2014 was $17 thousand, a

decrease of $0.1 million, or 85%, from the year ended December 31, 2013.

Interest expense for the year ended December 31, 2014 was $0.2 million, an increase of $0.2 million, from the year ended December 31, 2013. This

increase was primarily attributable to interest on our capital leases and the amortization of deferred financing fees associated with our revolving credit

facility, which we entered into in November 2014.

Other income (expense) for the year ended December 31, 2014 was an expense of $1.1 million, an increase of $1.5 million, as compared to other income

of $0.4 million for the year ended December 31, 2013. The increase in expense was primarily attributable to foreign exchange losses.

45