Rosetta Stone 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

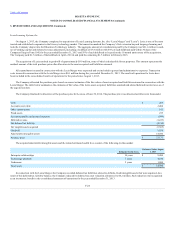

The credit facility contains customary events of default, including among others, non-payment defaults, covenant defaults, bankruptcy and insolvency

defaults, and a change of control default, in each case, subject to customary exceptions. The occurrence of a default event could result in the Bank’s

acceleration of repayment obligations of any loan amounts then outstanding.

As of December 31, 2015, there were no borrowings outstanding and the Company was eligible to borrow the entire $25.0 million of available credit

and $4.0 million in letters of credit have been issued by the Bank on the Company's behalf. A quarterly commitment fee accrues on any unused portion of the

credit facility at a nominal annual rate.

Capital Leases

The Company enters into capital leases under non-committed arrangements for equipment and software. In addition, as a result of the Tell Me More

Merger, the Company assumed a capital lease for a building near Versailles, France, where Tell Me More’s headquarters are located. The fair value of the

lease liability at the date of acquisition was $4.0 million.

During the years ended December 31, 2015, 2014, 2013, the Company acquired equipment or software through the issuance of capital leases totaling

$0.5 million, zero, $0.7 million, respectively. This non-cash investing activity has been excluded from the consolidated statement of cash flows.

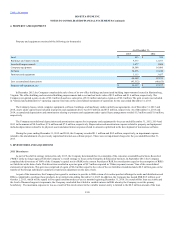

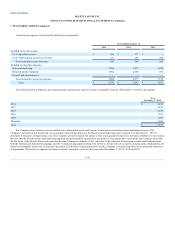

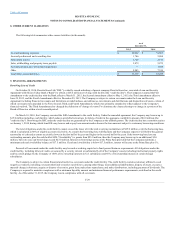

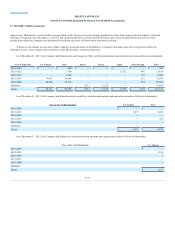

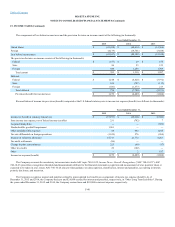

As of December 31, 2015, the future minimum payments under capital leases with initial terms of one year or more are as follows (in thousands):

Periods Ending December 31,

2016

$ 644

2017

645

2018

493

2019

492

2020

492

Thereafter

855

Total minimum lease payments

$ 3,621

Less amount representing interest

478

Present value of net minimum lease payments

$ 3,143

Less current portion

521

Obligations under capital lease, long-term

$ 2,622

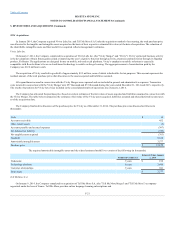

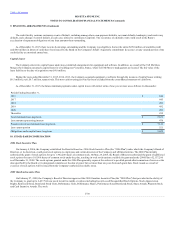

2006 Stock Incentive Plan

On January 4, 2006, the Company established the Rosetta Stone Inc. 2006 Stock Incentive Plan (the "2006 Plan") under which the Company's Board of

Directors, at its discretion, could grant stock options to employees and certain directors of the Company and affiliated entities. The 2006 Plan initially

authorized the grant of stock options for up to 1,942,200 shares of common stock. On May 28, 2008, the Board of Directors authorized the grant of additional

stock options for up to 195,000 shares of common stock under the plan, resulting in total stock options available for grant under the 2006 Plan of 2,137,200

as of December 31, 2008. The stock options granted under the 2006 Plan generally expire at the earlier of a specified period after termination of service or the

date specified by the Board or its designated committee at the date of grant, but not more than ten years from such grant date. Stock issued as a result of

exercises of stock options will be issued from the Company's authorized available stock.

2009 Omnibus Incentive Plan

On February 27, 2009, the Company's Board of Directors approved the 2009 Omnibus Incentive Plan (the "2009 Plan") that provides for the ability of

the Company to grant up to 2,437,744 new stock incentive awards or options including Incentive and Nonqualified Stock Options, Stock Appreciation

Rights, Restricted Stock, Restricted Stock Units, Performance Units, Performance Shares, Performance based Restricted Stock, Share Awards, Phantom Stock

and Cash Incentive Awards. The stock

F-30