Rosetta Stone 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

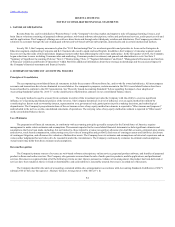

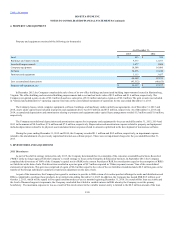

Expenses for repairs and maintenance that do not extend the life of equipment are charged to expense as incurred. Expenses for major renewals and

betterments, which significantly extend the useful lives of existing property and equipment, are capitalized and depreciated. Upon retirement or disposition

of property and equipment, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized.

In accordance with ASC topic 360, ("ASC 360"), the Company evaluates the recoverability of its long-lived assets.

ASC 360 requires recognition of impairment of long-lived assets in the event that the net book value of such assets exceeds the future undiscounted net cash

flows attributable to such assets. Impairment, if any, is recognized in the period of identification to the extent the carrying amount of an asset exceeds the fair

value of such asset. During the years ended December 31, 2015 and 2014, the Company recorded impairment expense of $1.1 million and $0.2 million,

respectively, related to the abandonment of a previously capitalized internal-use software projects. There were no impairments of its long-lived assets during

the year ended December 31, 2013.

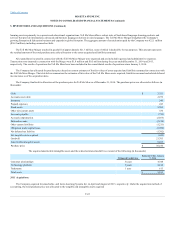

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark, and

other intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives in

accordance with ASC topic 350, ("ASC 350"). Annually, as of December 31, and more frequently if a triggering event

occurs, the Company reviews its indefinite-lived intangible asset for impairment in accordance with ASC 350. This guidance provides the option to first

assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining

whether it is necessary to perform the quantitative test. If necessary, the quantitative test is performed by comparing the fair value of indefinite lived

intangible assets to the carrying value. In the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. The

Rosetta Stone trade name is the Company's only indefinite-lived intangible asset.

During the fourth quarter of 2015, the Company elected to bypass the qualitative assessment and performed the quantitative assessment. In the

quantitative assessment, the fair value of the Rosetta Stone trade name has declined due to the reduction in forecasted revenue and bookings from both the

Enterprise & Education Language and the Consumer Language reporting units, however, the fair value exceeded the carrying value. There has been no

impairment of intangible assets during any of the periods presented.

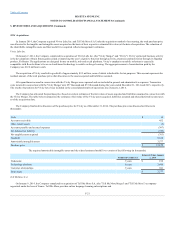

Goodwill represents purchase consideration paid in a business combination that exceeds the values assigned to the net assets of acquired businesses.

The Company tests goodwill for impairment annually on June 30 of each year or more frequently if impairment indicators arise. Goodwill is tested for

impairment at the reporting unit level using a fair value approach, in accordance with the provisions of ASC 350. This guidance provides the option to first

assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value, a "Step 0"

analysis. If, based on a review of qualitative factors, it is more likely than not that the fair value of a reporting unit is less than its carrying value the Company

performs "Step 1" of the traditional two-step goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount. If the carrying

value exceeds the fair value, the Company measures the amount of impairment loss, if any, by comparing the implied fair value of the reporting unit goodwill

with its carrying amount, the "Step 2" analysis.

During the fourth quarter of 2015, the Company determined that sufficient indication existed to require performance of an interim goodwill impairment

analysis for the Consumer Fit Brains reporting unit. As a result, the Company recorded an impairment loss of $5.6 million associated with the interim

impairment assessment of the Consumer Fit Brains reporting unit as of December 31, 2015. During the fourth quarter of 2015, the Company also determined

that sufficient indication existed to require performance of an interim goodwill impairment analysis for the Enterprise & Education Language reporting unit

beginning with a Step1 analysis. While this analysis did indicate that the fair value of the Enterprise & Education Language reporting unit declined, the fair

value is still greater than the carrying value of this reporting unit. Since the Enterprise & Education Language reporting unit passed the Step 1 test, no further

analysis or testing under Step 2 was necessary and no impairment charges were recorded in connection with this interim impairment assessment of this

reporting unit.

F-13