Rosetta Stone 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Software products include sales to end user customers and resellers. In many cases, revenue from sales to resellers is not contingent upon resale of the

software to the end user and is recorded in the same manner as all other product sales. Revenue from sales of packaged software products and audio practice

products is recognized as the products are shipped and title passes and risks of loss have been transferred. For many product sales, these criteria are met at the

time the product is shipped. For some sales to resellers and certain other sales, the Company defers revenue until the customer receives the product because

the Company legally retains a portion of the risk of loss on these sales during transit. In other cases where packaged software products are sold to resellers on

a consignment basis, revenue is recognized for these consignment transactions once the end user sale has occurred, assuming the remaining revenue

recognition criteria have been met. In accordance with ASC subtopic 605-50, (“ASC 605-50”),

cash sales incentives to resellers are accounted for as a reduction of revenue, unless a specific identified benefit is identified and the fair value is reasonably

determinable. Price protection for changes in the manufacturer suggested retail value granted to resellers for the inventory that they have on hand at the date

the price protection is offered is recorded as a reduction to revenue at the time of sale.

The Company offers customers the ability to make payments for packaged software purchases in installments over a period of time, which typically

ranges between three and five months. Given that these installment payment plans are for periods less than 12 months, a successful collection history has

been established and these fees are fixed and determinable, revenue is recognized at the time of sale, assuming the remaining revenue recognition criteria

have been met.

In connection with packaged software product sales and web-based software subscriptions, technical support is provided to customers, including

customers of resellers, via telephone support at no additional cost for up to six months from the time of purchase. As the fee for technical support is included

in the initial licensing fee, the technical support and services are generally provided within one year, the estimated cost of providing such support is deemed

insignificant and no unspecified upgrades/enhancements are offered, technical support revenue is recognized together with the software product and web-

based software subscription revenue. Costs associated with the technical support are accrued at the time of sale.

Sales commissions from non-cancellable web-based software subscription contracts are deferred and amortized in proportion to the revenue recognized

from the related contract.

The Company deconsolidates divested subsidiaries when there is a loss of control or when appropriate when evaluated under the variable interest

entity model. The Company recognizes a gain or loss at divestiture equal to the difference between the fair value of any consideration received and the

carrying amount of the former subsidiary’s assets and liabilities. Any resulting gain or loss is reported in "Other income and (expense)" on the consolidated

statement of operations.

The Company recognizes all of the assets acquired, liabilities assumed and contractual contingencies from an acquired company as well as contingent

consideration at fair value on the acquisition date. The excess of the total purchase price over the fair value of the assets and liabilities acquired is recognized

as goodwill. Acquisition-related costs are recognized separately from the acquisition and expensed as incurred. Generally, restructuring costs incurred in

periods subsequent to the acquisition date are expensed when incurred. Subsequent changes to the purchase price (i.e., working capital adjustments) or other

fair value adjustments determined during the measurement period are recorded as adjustments to goodwill.

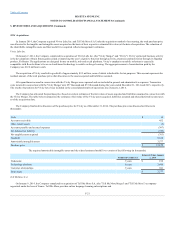

Cash and cash equivalents consist of highly liquid investments with original maturities of three months or less and demand deposits with financial

institutions.

Restricted cash is generally used to reimburse funds to employees under the Company's flexible benefit plan.

Accounts receivable consist of amounts due to the Company from its normal business activities. The Company provides an allowance for doubtful

accounts to reflect the expected non-collection of accounts receivable based on past collection history and specific risks identified.

F-11