Rosetta Stone 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

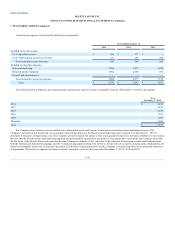

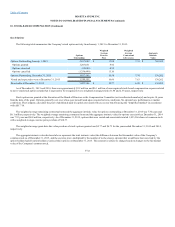

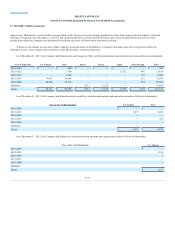

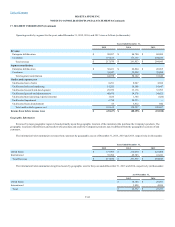

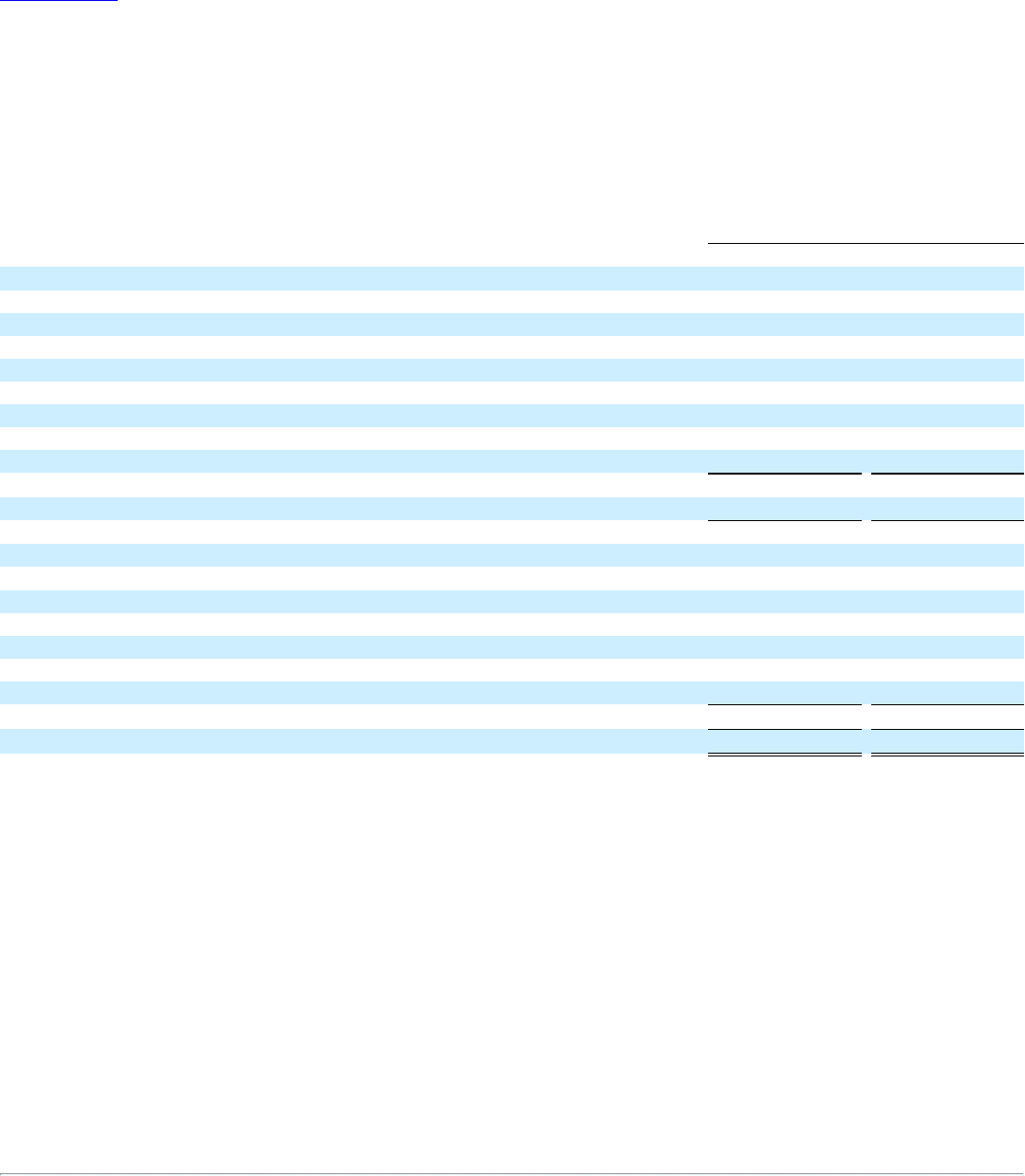

The following table summarizes the significant components of the Company's deferred tax assets and liabilities as of December 31, 2015 and 2014 (in

thousands):

Deferred tax assets:

Inventory

$ 564

$ 535

Net operating and capital loss carryforwards

48,334

27,637

Deferred revenue

13,908

12,447

Accrued liabilities

9,780

12,890

Stock-based compensation

4,656

5,760

Amortization and depreciation

31

—

Bad debt reserve

398

501

Foreign and other tax credits

1,517

1,283

Gross deferred tax assets

79,188

61,053

Valuation allowance

(70,464)

(53,809)

Net deferred tax assets

8,724

7,244

Deferred tax liabilities:

Goodwill and indefinite lived intangibles

(4,782)

(3,465)

Deferred sales commissions

(7,337)

(5,714)

Prepaid expenses

(625)

(555)

Amortization and depreciation

—

(1,337)

Foreign currency translation

(973)

(391)

Other

(5)

(5)

Gross deferred tax liabilities

(13,722)

(11,467)

Net deferred tax liabilities

$ (4,998)

$ (4,223)

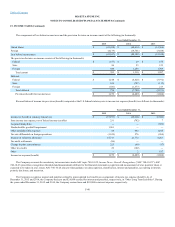

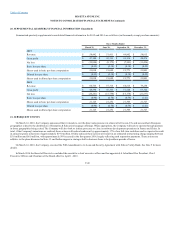

For the year ended December 31, 2015, the Company recorded income tax expense of $1.2 million primarily related to current year operations in

Germany and the UK and the tax impact of the amortization of indefinite lived intangibles, and the inability to recognize tax benefits associated with current

year losses of operations in all other foreign jurisdictions and in the U.S. due to the valuation allowance recorded against the deferred tax asset balances of

these entities. These tax expenses were partially offset by tax benefits related to current year losses (excluding the Consumer Fit Brains goodwill impairment)

in Canada. The goodwill that was impaired is not deductible for tax. Additionally, tax benefits were recorded related to the reversal of accrued withholding

taxes as a result of an intercompany transaction.

For the year ending December 31, 2014, the Company recorded an income tax benefit of $6.5 million primarily resulting from the tax benefits related

to the goodwill impairment taken during the first quarter of 2014 related to the ROW Consumer reporting unit, the goodwill impairment taken during the

fourth quarter of 2014 related to the North America Consumer Language reporting unit, and current year losses in Canada and France. The goodwill that was

impaired related to acquisitions from prior years, a portion of which resulted in a tax benefit as a result of writing off a deferred tax liability previously

recorded (i.e., goodwill had tax basis and was amortized for tax). These tax benefit amounts were partially offset by income tax expense related to profits from

certain foreign operations and foreign withholding taxes. The tax benefits were also partially offset by the tax expense related to the tax impact of

amortization of indefinite lived intangibles, and the inability to recognize tax benefits associated with current year losses of operation in all other foreign

jurisdictions and in the U.S. due to the valuation allowance recorded against the deferred tax asset balances of these entities.

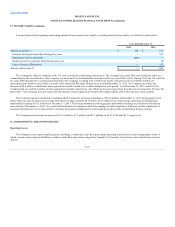

During the third quarter of 2012, the Company established a full valuation allowance to reduce the deferred tax assets of its operations in Brazil, Japan,

and the U.S., resulting in a non-cash charge of $0.4 million, $2.1 million, and $23.1 million,

F-38