Rosetta Stone 2015 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Research and development expenses consist primarily of employee compensation costs, consulting fees, and overhead

costs associated with development of our solutions. Our development efforts are primarily based in the U.S. and are devoted to modifying and expanding our

offering portfolio through the addition of new content and new paid and complementary products and services to our language-learning, literacy, and brain

fitness solutions.

General and administrative expenses consist primarily of shared services, such as personnel costs of our executive,

finance, legal, human resources and other administrative personnel, as well as accounting and legal professional services fees including professional service

fees related to acquisition and other corporate expenses.

Impairment expenses consist primarily of goodwill impairment and impairment expense related to the abandonment of previously

capitalized internal-use software projects.

Lease abandonment and termination expenses include the recognition of costs associated with the termination

or abandonment of certain of our office operating leases, such as early termination fees and expected lease termination costs.

Interest and other income (expense) primarily consist of interest income, interest expense, foreign exchange gains and losses, income from litigation

settlements, and income or loss from equity method investments. Interest income represents interest received on our cash and cash equivalents. Interest

expense is primarily related to interest on our capital leases and the amortization of deferred financing fees associated with our revolving credit facility.

Fluctuations in foreign currency exchange rates in our foreign subsidiaries cause foreign exchange gains and losses. Legal settlements are related to agreed

upon settlement payments from various anti-piracy enforcement efforts. Income or loss from equity method investments represents our proportionate share of

the net income or loss of our investment in entities accounted for under the equity method.

Income tax expense (benefit) consists of federal, state and foreign income taxes.

We regularly evaluate the recoverability of our deferred tax assets and establish a valuation allowance, if necessary, to reduce the deferred tax assets to

an amount that is more likely than not to be realized (a likelihood of more than 50 percent). Significant judgment is required to determine whether a

valuation allowance is necessary and the amount of such valuation allowance, if appropriate.

The establishment of a valuation allowance has no effect on the ability to use the deferred tax assets in the future to reduce cash tax payments. We

assess the likelihood that the deferred tax assets will be realizable at each reporting period, and the valuation allowance will be adjusted accordingly, which

could materially affect our financial position and results of operations.

In presenting our financial statements in conformity with GAAP, we are required to make estimates and assumptions that affect the reported amounts of

assets, liabilities, revenues, costs and expenses, and related disclosures.

Some of the estimates and assumptions we are required to make relate to matters that are inherently uncertain as they pertain to future events. We base

these estimates and assumptions on historical experience or on various other factors that we believe to be reasonable and appropriate under the

circumstances. On an ongoing basis, we reconsider and evaluate our estimates and assumptions. Our future estimates may change if the underlying

assumptions change. Actual results may differ significantly from these estimates.

We believe that the following critical accounting policies involve our more significant judgments, assumptions and estimates and, therefore, could

have the greatest potential impact on our consolidated financial statements. In addition, we believe that a discussion of these policies is necessary for readers

to understand and evaluate our consolidated financial statements contained in this annual report on Form 10-K.

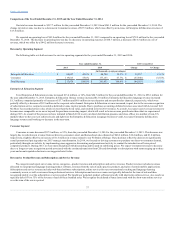

Revenue Recognition

Our primary sources of revenue are web-based software subscriptions, online services, perpetual product software, and bundles of perpetual product

software and online services. We also generate revenue from the sale of audio practice products, mobile applications, and professional services. Revenue is

recognized when all of the following criteria are met: there is persuasive evidence of an arrangement; the product has been delivered or services have been

rendered; the fee is fixed or determinable; and collectability is reasonably assured. Revenues are recorded net of discounts.

30