Rosetta Stone 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

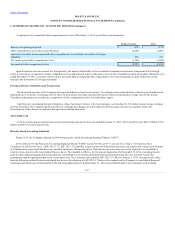

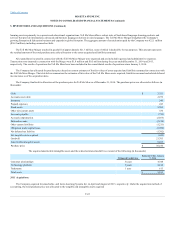

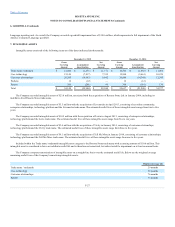

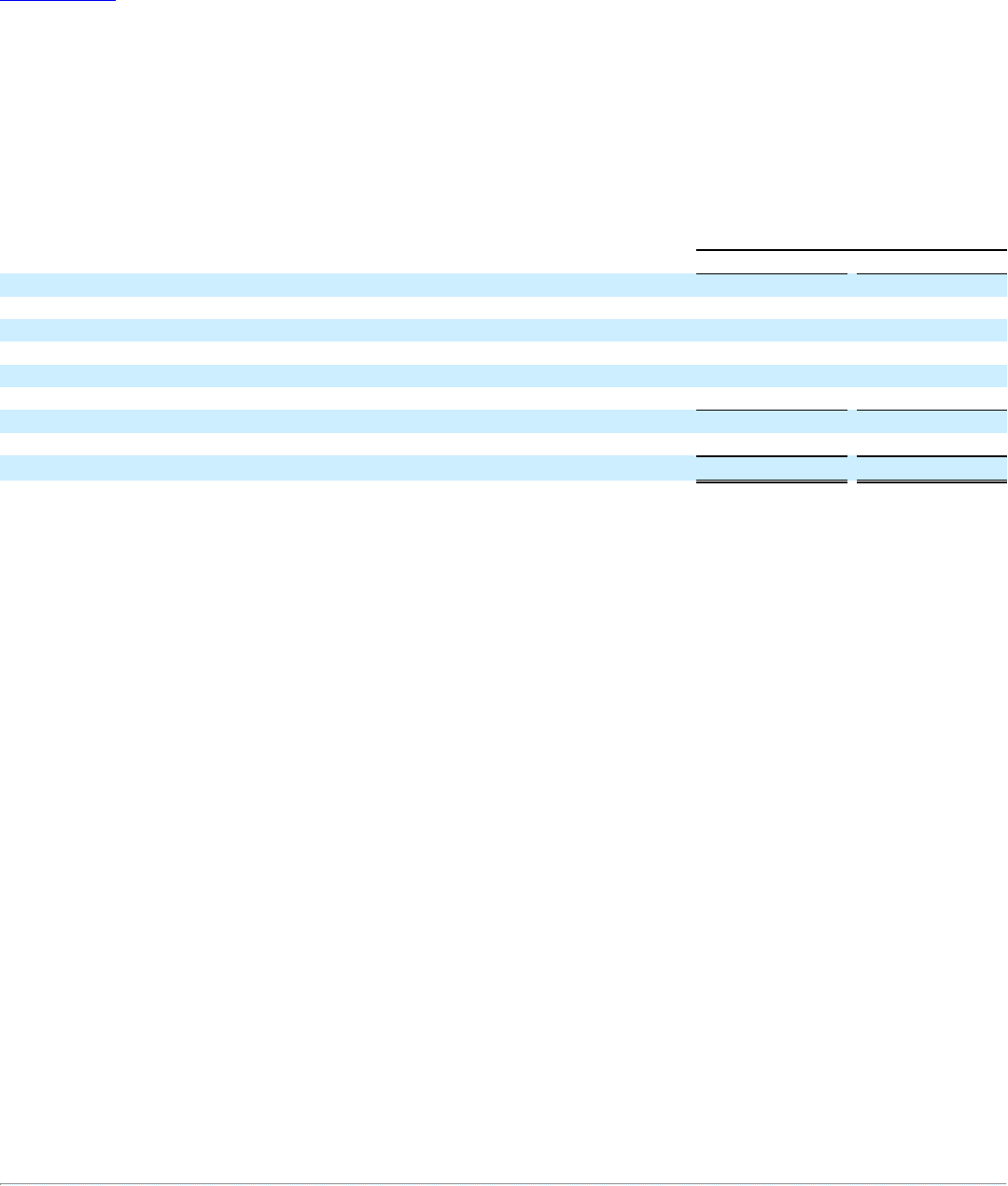

Property and equipment consisted of the following (in thousands):

Land

$ 893

$ 950

Buildings and improvements

9,573

12,477

Leasehold improvements

1,477

1,408

Computer equipment

16,508

16,400

Software

34,478

31,240

Furniture and equipment

3,115

3,457

66,044

65,932

Less: accumulated depreciation

(43,512)

(40,655)

Property and equipment, net

$ 22,532

$ 25,277

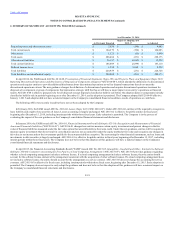

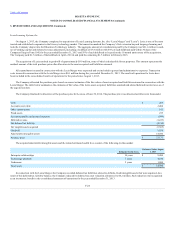

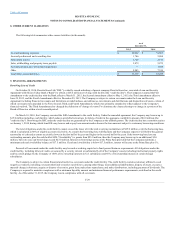

In December 2015, the Company completed the sale of one of its two office buildings and associated building improvements located in Harrisonburg,

Virginia. The office building and associated building improvements had a cost and net book value of $2.5 million and $1.6 million, respectively. The

Company recognized a gain on sale of $0.1 million based on a sales price of $1.8 million and sales expenses of $0.1 million. The gain on sale was included

in "General and administrative" operating expense line item on the consolidated statements of operations for the year ended December 31, 2015.

The Company leases certain computer equipment, software, buildings, and machinery under capital lease agreements. As of December 31, 2015 and

2014, assets under capital lease included in property and equipment above was $5.5 million and $5.6 million, respectively. As of December 31, 2015 and

2014, accumulated depreciation and amortization relating to property and equipment under capital lease arrangements totaled $1.5 million and $1.0 million,

respectively.

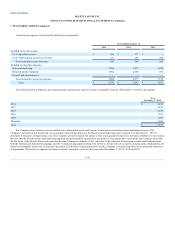

The Company recorded total depreciation and amortization expense for its property and equipment for the years ended December 31, 2015, 2014 and

2013 in the amount of $8.5 million, $7.6 million and $7.8 million, respectively. Depreciation and amortization expense related to property and equipment

includes depreciation related to its physical assets and amortization expense related to amounts capitalized in the development of internal-use software.

During the years ending December 31, 2015 and 2014, the Company recorded $1.1 million and $0.2 million, respectively, in impairment expense

related to the abandonment of a previously capitalized internal-use software project. There were no impairment charges for the year ended December 31,

2013.

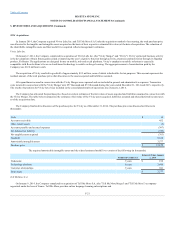

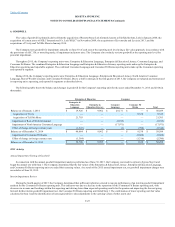

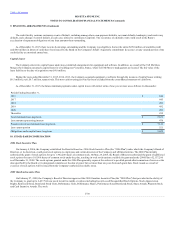

2015 Divestitures:

As part of the shift in strategy initiated in early 2015, the Company determined that its ownership of the consumer-oriented Rosetta Stone Korea Ltd.

("RSK") entity no longer agreed with the Company’s overall strategy to focus on the Enterprise & Education business. In September 2015, the Company

completed the divestiture of 100% of the Company's capital stock of RSK to the current President of RSK for consideration equal to the assumption of RSK's

net liabilities at the date of sale. This divestiture resulted in a pre-tax gain of $0.7 million reported in “Other (expense) income” line of the consolidated

statements of operations. This gain was comprised of a gain of $0.2 million equal to the value of the net liabilities transferred and a $0.5 million gain on the

transfer of the foreign subsidiary's cumulative translation adjustment on the date of sale.

As part of the transaction, the Company has agreed to continue to provide to RSK certain of its online product offerings for resale and distribution and

RSK is committed to purchase those products, for an initial term ending December 31, 2025. In addition, the Company has loaned RSK $0.5 million as of

October 2, 2015, which will be repaid in five equal installments due every six months beginning December 31, 2016. As a result of this loan receivable and

the level of financial support it represents, the Company concluded that it holds a variable interest in RSK whereby the Company is not the primary

beneficiary. The maximum exposure to loss as a result of this involvement in the variable interest entity is limited to the $0.5 million amount of the loan.

F-20