Rosetta Stone 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Rosetta Stone Inc. and its subsidiaries ("Rosetta Stone," or the "Company") develop, market and support a suite of language-learning, literacy, and

brain fitness solutions consisting of perpetual software products, web-based software subscriptions, online and professional services, audio practice tools and

mobile applications. The Company's offerings are sold on a direct basis and through select third party retailers and distributors. The Company provides its

solutions to customers through the sale of packaged software and web-based software subscriptions, domestically and in certain international markets.

In early 2015, the Company announced a plan (the "2015 Restructuring Plan") to accelerate growth in and prioritize its focus on the Enterprise &

Education segment, emphasizing Corporate and K-12 learners who need to speak and read English. In addition, the Company’s Consumer segment would

focus on serving the needs of more passionate language learners rather than addressing the entire mass marketplace. In the first quarter of 2015, the Company

began reductions to areas including Consumer sales and marketing, Consumer product investment, and general and administrative costs. See Note 2

"Summary of Significant Accounting Policies," Note 13 "Restructuring," Note 17 "Segment Information" and Item 7 "Management's Discussion and Analysis

of Financial Condition and Results of Operations" within Part II for additional information about these strategic undertakings and the associated impact to

the Company's financial statements and financial results.

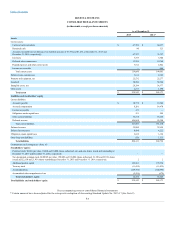

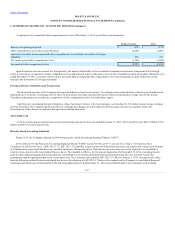

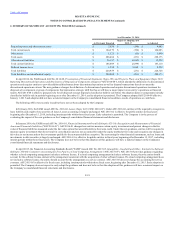

The accompanying consolidated financial statements include the accounts of Rosetta Stone Inc. and its wholly owned subsidiaries. All intercompany

accounts and transactions have been eliminated in consolidation. For comparative purposes, certain amounts in the 2014 consolidated balance sheet have

been reclassified to conform to the 2015 presentation. See “Recently Issued Accounting Standards” below regarding the impact of our adoption of

Accounting Standards Update No. 2015-17 on the classification of deferred tax amounts in our consolidated balance sheets.

The equity method is used to account for investments in entities if the investment provides the Company with the ability to exercise significant

influence over operating and financial policies of the investee. The Company determines its level of influence over an equity method investment by

considering key factors such as ownership interest, representation on a governance body, participation in policy-making decisions, and technological

dependencies. The Company's proportionate share of the net income or loss of any equity method investments is reported in "Other income and (expense)"

and included in the net loss on the consolidated statements of operations. The carrying value of any equity method investment is reported in "Other assets"

on the consolidated balance sheets.

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America, requires

management to make certain estimates and assumptions. The amounts reported in the consolidated financial statements include significant estimates and

assumptions that have been made, including, but not limited to, those related to revenue recognition, allowance for doubtful accounts, estimated sales returns

and reserves, stock-based compensation, restructuring costs, fair value of intangibles and goodwill, disclosure of contingent assets and liabilities, disclosure

of contingent litigation, and allowance for valuation of deferred tax assets. The Company bases its estimates and assumptions on historical experience and on

various other judgments that are believed to be reasonable under the circumstances. The Company continuously evaluates its estimates and assumptions.

Actual results may differ from these estimates and assumptions.

The Company's primary sources of revenue are web-based software subscriptions, online services, perpetual product software, and bundles of perpetual

product software and online services. The Company also generates revenue from the sale of audio practice products, mobile applications, and professional

services. Revenue is recognized when all of the following criteria are met: there is persuasive evidence of an arrangement; the product has been delivered or

services have been rendered; the fee is fixed or determinable; and collectability is reasonably assured. Revenue is recorded net of discounts.

The Company identifies the units of accounting contained within sales arrangements in accordance with Accounting Standards Codification ("ASC")

subtopic 605-25 (“ASC 605-25”). In

F-9